Zscaler (ZS) to Buy Trustdome to Boost Cloud Protection Portfolio

Zscaler, Inc. ZS recently signed a definitive acquisition deal to buy Cloud Infrastructure Entitlement Management (CIEM) player — Trustdome — for an undisclosed amount. The acquisition will not only help Zscaler tap into the Israeli market where it plans to expand its presence, but will also embolden its Cloud Security Posture Management (CSPM) platform. The transaction is expected to close by this month.

Public cloud environments face a major security challenge from the plethora of discrete permissions, many of which remain unchecked. This opens a window for unethical hackers to attack cloud deployments. Notably, Trustdome’s CIEM platform addresses this issue by enforcing boundaries on who and what has access to data, applications and services in public cloud environments. By adding Trustdome’s CIEM platform to its Cloud Protection portfolio, Zscalar will be empowered to provide stronger cloud security to enterprises, thus enabling DevOps to focus on innovation rather than security.

Notably, Zscaler is benefiting from the rising demand for security and networking products amid the COVID-19 crisis. Moreover, the growing adoption of cloud due to the increasing trend of everything-from-home is leading to various security challenges, boosting the demand for Zscalar’s solutions. In the last reported quarter, revenues of $157 million jumped 55% year over year, driven by a rise in the adoption of the company’s cloud platform security solutions by global enterprises.

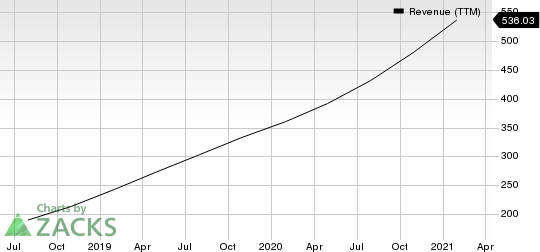

Zscaler, Inc. Revenue (TTM)

Zscaler, Inc. revenue-ttm | Zscaler, Inc. Quote

Acquisitions to Boost Growth

Zscaler has made a few strategic acquisitions to boost growth. In May last year, the company acquired Edgewise, which focuses on securing communications among applications running in cloud and datacenter networks. Prior to this, the company bought CSPM company, Cloudneeti. Cloudneeti prevents and remediates application misconfigurations and compliance violations in SaaS, IaaS and PaaS.

We believe these acquisitions have not only strengthened the data-protection capabilities of Zscaler but have expanded its customer base as well.

Zscaler has a strong balance sheet with ample liquidity position and fewer debt obligations. Cash and short-term investments were $1.44 billion, while total debt (including current maturities) was $887 million as of Jan 31, 2021. It is to be noted that the company has been able to regularly increase its cash and marketable securities, as well as cash from operations, in the last three fiscal years.

The increasing liquidity and cash flow trends reflect that the company is making investments in the right direction. Moreover, since it carries a low long-term debt, the excess cash is available for pursuing strategic acquisitions, investment in growth initiatives and distribution to shareholders.

Zacks Rank & Stocks to Consider

Zscaler currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the broader technology sector are Ubiquiti Inc. UI, Micron Technology, Inc. MU and Etsy, Inc. ETSY, each sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Ubiquiti, Micron and Etsy is currently pegged at 32.94%, 15.66% and 25.25%, respectively.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Etsy, Inc. (ETSY) : Free Stock Analysis Report

Ubiquiti Inc. (UI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance