Zscaler (ZS) Adds AI/ML Capabilities to Zero Trust Exchange

Zscaler ZS recently announced the addition of new artificial intelligence (AI) and machine learning (ML) capabilities to its zero-trust security solution — Zscaler Zero Trust Exchange (“ZTE”). With this update, the company intends to improve the implementation of Security Service Edge (SSE) by organizations while preventing them from the most advanced cyber attacks.

The AI-backed SSE platform will ensure simplified adoption of Zscaler’s zero trust architecture among the users with assurance of a better digital experience and unique protection.

Zscaler’s ZTE is a purpose-built cloud platform that reduces risks in digital businesses by ensuring safer digital transformation than traditional virtual private networks and firewalls. It enables direct and secure connections based on trust built upon users’ identity and contexts, such as their location, their device’s security posture, the content being exchanged and the application being requested. Currently, the platform is operating across 150 data centers worldwide.

The newly updated ZTE platform features AI-powered phishing prevention to detect and block credential theft and browser exploitation from phishing pages, AI-powered segmentation to simplify user-to-app segmentation while minimizing attack surfaces and stopping lateral movement with AI-based policy recommendations. It also features AI-powered root cause analysis that instantly identifies root causes of poor user experiences 180 times faster and enables security teams to focus more on blocking attacks and less on time-consuming troubleshooting issues.

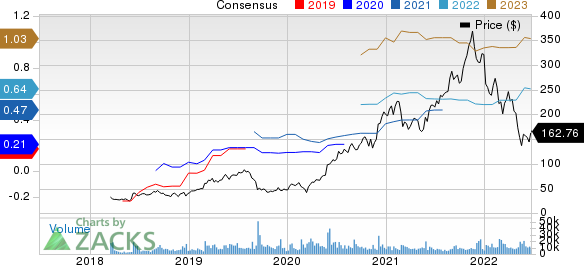

Zscaler, Inc. Price and Consensus

Zscaler, Inc. price-consensus-chart | Zscaler, Inc. Quote

Zscaler’s latest update to ZTE intends to ensure that the organizations get access to automated threat detection and better protection with reduced risks.

Recently, Zscaler extended its partnership with Amazon’s AMZN Amazon Web Services (AWS) to help enterprises securely accelerate their transition to the cloud. The company unveiled a new Posture Control solution — Cloud-Native Application Protection Platform — built on AWS.

The company extended its ZTE solution to the Amazon subsidiary. Currently, Zscaler facilitates enterprises’ inline inspection of Internet traffic from cloud workloads utilizing deep integration with Amazon’s cloud-native technologies, which include AWS Secrets Manager, AWS CloudFormation, Gateway Load Balancer and AWS Auto Scaling.

Last year in September, the global cloud security leader inked a partnership with TD SYNNEX SNX to provide ZTE solutions to the business partners and organizations.

Through this deal, Zscaler accelerated TD SYNNEX’s security portfolio while offering more agility to its business partners as their network and security needs continue to evolve. Zscaler enhanced its available options for speeding up the migration journey into zero trust architecture.

Zacks Rank & A Key Pick

Zscaler and TD SYNNEX currently carry a Zacks Rank #3 (Hold), while Amazon has a Zacks Rank of 5 (Strong Sell). Shares of ZS, SNX and AMZN have plunged 25.9%, 22.7% and 34.8%, respectively, in the past year.

A better-ranked stock from the broader Computer and Technology sector is Analog Devices ADI flaunting a Zacks Rank #1 (Strong Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Analog Devices' third-quarter fiscal 2022 earnings has been revised upward by 24 cents to $2.42 per share over the past 60 days. For fiscal 2022, earnings estimates have moved 81 cents north to $9.24 per share in the past 60 days.

Analog Devices' earnings beat the Zacks Consensus Estimate in each of the preceding four quarters, the average surprise being 7.7%. Shares of ADI have fallen 12.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance