Zoom (ZM) Q1 Earnings Beat, Customer Growth Drives Revenues

Zoom Video Communication’s ZM first-quarter fiscal 2024 adjusted earnings of $1.16 per share beat the Zacks Consensus Estimate by 17.1% and increased 5.4% year over year.

Revenues of $1.10 billion beat the consensus mark by 2.01% and increased 13% year over year on strong growth from enterprise customers.

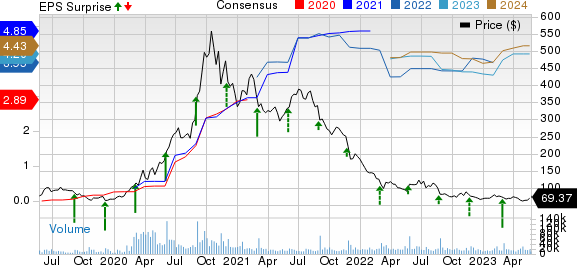

Zoom Video Communications, Inc. Price, Consensus and EPS Surprise

Zoom Video Communications, Inc. price-consensus-eps-surprise-chart | Zoom Video Communications, Inc. Quote

Quarter Details

Revenues from Enterprise customers grew 13% year over year and represented 57% of total revenues, up from 52% in first-quarter fiscal 2023. In the fiscal first quarter, customers contributing more than $100,000 in revenues in the trailing 12 months grew 23% to 3,580. These customers accounted for 29% of revenues, up from 24% in the year-ago quarter.

The company reported a trailing 12-month net dollar expansion rate for Enterprise customers of 112%.

The number of Enterprise customers grew 19% year over year to approximately 215,900. Zoom Phone surpassed 10% of revenues in the quarter for the first time. Emerging technologies, such as Zoom Contact Center picked up pace as customer experience teams recognized the value of modern and integrated collaboration solution.

Revenues increased 8% in America, while international market revenues from APAC declined 5% year over year. EMEA revenues decreased 8% year over year.

Operating Details

Non-GAAP gross margin expanded 190 basis points (bps) to 80.5% in the fiscal first quarter of 2024.

Research and development expenses increased 1.71% year over year to $106.2 million. Sales and marketing expenses increased 0.28% to $278.08 million, while general and administrative expenses decreased 1.08% to $83.5 million.

Non-GAAP operating income increased 5.6% to $422.3 million year over year. Non-GAAP operating margin expanded 99 bps to 38.2%.

Balance Sheet and Cash Flow

Total cash, cash equivalents and marketable securities as of Apr 30, 2023, was $5.6 billion. As of Jan 31, 2023, cash, cash equivalents and marketable securities were $5.41 billion.

Free cash flow as of Apr 30, 2023, was $396.7 million. As of Jan 31, 2023, adjusted free cash flow was $183.2 million.

Guidance

Zoom expects second-quarter fiscal 2024 revenues in the range of $1.110 billion to $1.115 billion.

Non-GAAP earnings per share are expected in the range of $1.04 to $1.06.

For fiscal 2024, Zoom expects revenues in the range of $4.465 billion to $4.485 billion.

Non-GAAP earnings per share are expected in the range of $4.25 to $4.31.

Zacks Rank & Key Picks

Currently, Zoom Video carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Computer and Technology sector can consider some better-ranked stocks like Ciena CIEN, DigitalOcean DOCN and AMETEK AME. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Ciena have lost 10.6% in the year-to-date period. The Zacks Consensus Estimate for CIEN’s 2023 earnings is pegged at $2.81 per share, suggesting an increase of 47.9% from the prior year’s reported figure.

Shares of DigitalOcean have risen 37.3% in the year-to-date period. The Zacks Consensus Estimate for DOCN’s 2023 earnings is pegged at $1.68 per share, suggesting a jump from 94 cents reported in the prior year.

Shares of AMETEK have rallied 5.9% year to date. The Zacks Consensus Estimate for AME’s 2023 earnings is pegged at $6.11 per share, suggesting an increase of 7.57% from the prior year’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ciena Corporation (CIEN) : Free Stock Analysis Report

AMETEK, Inc. (AME) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

DigitalOcean Holdings, Inc. (DOCN) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance