Zayo (ZAYO) Q1 Earnings & Revenues Miss Estimates, Fall Y/Y

Zayo Group Holdings, Inc. ZAYO reported lackluster first-quarter fiscal 2020 results, wherein both the bottom line and the top line missed the respective Zacks Consensus Estimate. Revenues and income declined year over year despite robust infrastructure capacity demand for webscale, content and cloud providers.

Net Income

Net income for the September quarter was $17.9 million or 8 cents per share compared with $22.1 million or 9 cents per share a year ago. The year-over-year decline was primarily due to higher operating costs and lower revenues. The bottom line missed the Zacks Consensus Estimate by 10 cents.

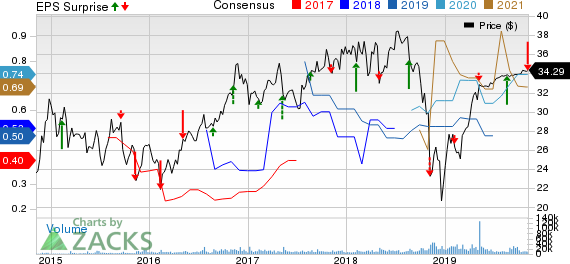

Zayo Group Holdings, Inc. Price, Consensus and EPS Surprise

Zayo Group Holdings, Inc. price-consensus-eps-surprise-chart | Zayo Group Holdings, Inc. Quote

Revenues

Quarterly revenues were $638.6 million, down 0.4% from $641.1 million year over year. The top line lagged the consensus estimate of $647 million. While revenues from Zayo Networks segment totaled $483.2 million, the same from Allstream totaled $86.6 million. Revenues from zColo were $63.7 million.

Other Quarterly Details

Operating income improved to $128.9 million from $122.8 million in the prior-year quarter, primarily due to lower operating expenses. Adjusted EBITDA was $314.8 million compared with $319.4 million in the year-ago quarter with respective margins of 49% and 50%. Adjusted EBITDA from Zayo Networks was $277.5 million, $26.6 million from zColo and $9.3 million from Allstream. Capital expenditures were $217.1 million.

On a monthly recurring revenue and monthly amortized revenue basis, consolidated net installs were $0.9 million (excluding Allstream segment), which includes $1.1 million of net installs from the Zayo Networks segment and ($0.2) million from the zColo segment.

Update on Merger

With respect to its previously announced pending merger with affiliates of Digital Colony Partners and EQT Infrastructure IV fund, the company continues to make progress on all necessary approvals, and the transaction is expected to close in the first half of 2020. The closing is subject to customary conditions, including certain regulatory approvals.

Cash Flow & Liquidity

During the first fiscal quarter, Zayo generated $311.8 million of net cash from operating activities compared with $241.8 million in the year-ago quarter. Adjusted unlevered free cash flow was $138.8 million, up from $130.4 million.

As of Sep 30, 2019, the fiber optic bandwidth infrastructure company had $254.6 million in cash and equivalents compared with $353.9 million a year ago, and $5,696.1 million of long-term debt.

Zacks Rank & Stocks to Consider

Zayo currently has a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader industry are ATN International, Inc. ATNI, United States Cellular Corporation USM and Verizon Communications Inc. VZ, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ATN International surpassed earnings estimates twice in the trailing four quarters, the average positive surprise being 143.9%.

United States Cellular has long-term earnings growth expectation of 1%.

Verizon has long-term earnings growth expectation of 4.2%.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Zayo Group Holdings, Inc. (ZAYO) : Free Stock Analysis Report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

ATN International, Inc. (ATNI) : Free Stock Analysis Report

United States Cellular Corporation (USM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance