Year in Review 2017: Four companies to watch in 2018

Despite Canada’s reputation as a breadbasket for natural resources, recent years have seen that reputation shift towards technology and innovation. Montreal, Toronto and Vancouver have all been recognized as innovation epicentres, startup ecosystems generating an endless stream of forward-looking companies.

The most recent report on the tech sector (from 2016) shows its footprint at $117 billion or 7.1 per cent of Canada’s economic output – surpassing both the finance and insurance industries. The sector itself is made up of nearly 71,000 firms or 6.1 per cent of all Canadian businesses.

There’s a lot of competition when it comes to identifying the next great success story in Canadian business, but we took a look at some of the fastest moving companies and highlighted four technology companies to keep an eye on in 2018.

ecobee

Canada’s answer to the smart home trend, Toronto-based ecobee, has gained momentum with its home-grown smart WiFi thermostats. The latest iteration since 2014 (the company was founded in 2007) is called ecobee4 and arrives Alexis-enabled, giving homeowners access to Amazon’s intelligent personal assistant.

In addition to having a home field advantage, the product’s key differentiator from U.S.-based competitors like Alphabet’s Nest is the price point and ability to run multiple sensors says Dave Adamchick, a smart home analyst with market researchers The NPD Group.

“You get a little bit more fine-tuning in your home,” he says. Adamchick points out that while the firm’s research from 2015 showed only eight per cent of consumers owned a network connected energy management product, that number has “grown significantly” since then making it a prime opportunity for a company like ecobee.

“If you look at the install base, basically every home has a thermostat,” he says. Combined with the potential for energy savings and being able to adjust your home temperature without being present and using your smartphone puts these sorts of devices “top of mind” for consumers. “I think there’s definitely a pretty clear consumer advantage to these products being adopted more and more.”

League

Last year, news that gourmet pet food was making it onto employee benefits plans caught our attention. The company making the strange new employee perk available was League, a digital benefits platform from Hamilton-born serial entrepreneur and Kobo co-founder Mike Serbinis.

Launched in 2014, League pioneers a digital approach to benefits including health spending accounts, lifestyle spending accounts and workplace health services. “(League’s digital offering) is going to be very appealing to millennials – some of the words they’re using to brand this product, like ‘pick and pay’, speak to our millennials… they have the control,” Janet Salopek, partner and senior consultant at HR-focused Salopek and Associates told Yahoo Canada Finance last year.

And it’s gaining momentum. In October, Serbinis told the Globe and Mail that 2017 had been a milestone year, growing to 130 employees. The company is currently in the midst of expanding into the U.S. where he estimates companies spend “three to five times more per employee in offering health insurance.” League has big goals, with plans to be in the 10 largest U.S. cities by summer 2018 and reach $1 billion in business by the end of next year.

Hopper

It’s only been a year since Hopper, a Montreal-based startup which developed an app that predicts changes in airfare, received an $82-million vote of confidence in the form of a venture capital financing deal led by Canada’s second largest pension fund Caisse de dépôt et placement du Québec. Yet the company has already set its sights on another industry to disrupt: hotel-booking.

“Typically it would be laughable for us to take on a $100-billion [U.S.] company [like Priceline], but given the traction we’ve seen on mobile … it really feels like we can grow to several hundred million downloads globally and literally rebuild one of these mobile empires,” Hopper CEO and co-founder Frederic Lalonde told the Globe and Mail in October. “We have our sights set on literally owning mobile and displacing the two large giants that operate around the world.”

With its airfare model, the company’s app collects the user’s flight dates, analyzes patterns from online quotes, and sends them a notification when to book their travel. Hopper processes an estimated US$1.5-million worth of flight bookings daily.

Over the course of the next year, expect another hit app from Hopper as it collects and analyzes hotel prices and builds a similar engine to its airfare one. The company is in the process of developing its New York offerings with plans to expand to other markets including San Francisco, Las Vegas and Miami through 2018.

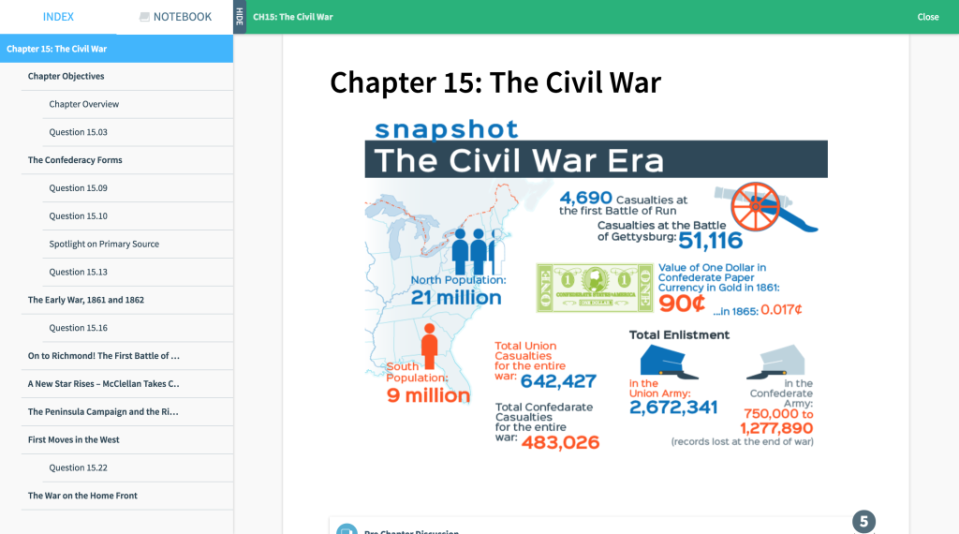

Top Hat

The Waterloo-founded education-tech company has already overhauled the way teachers interact with students via its smartphone, laptop and tablet-enabled platform. Top Hat is used in 75 per cent of North America’s top universities and colleges. Its revenue grew by 617 per cent from 2013 to 2016, earning it a place on Deloitte’s 2017 Technology Fast 50™ list.

But its recent push to usurp the textbook industry is sure to excite university and college students (and parents footing their kid’s post-secondary education bill). Earlier this year, the company rolled Top Hat Marketplace out of beta. The platform replaces the dated and overpriced textbook model with digital, teacher-generated affordable content.

“The traditional textbook needs to die,” Malgosia Green, chief product officer at Top Hat told TechToronto in July. “Over the last 200 years, universities have been hotbeds of technological innovation, and yet their classrooms and the textbooks used in those classrooms has hardly changed at all.”

Top Hat’s interactivity-focused learning tools are on trend with the way education is going, making them a company to watch, says Michelle Liem, who analyses the educational toys sphere at The NPD Group.

“Top Hat has really nailed it as far as being there at the right time when the world is ready to embrace this kind of thing,” she says. “Kids are growing up with it, for them, it’s a no-brainer… I think it helps that learning experience and takes it to a whole new level.”

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance