Xylem (XYL) Surpasses Q2 Earnings Estimates, Provides View

Xylem Inc. XYL has reported better-than-expected results for second-quarter 2020. Its earnings and sales surprise in the quarter was 2.6% and 2.1%, respectively.

Adjusted earnings in the quarter under review were 40 cents per share, surpassing the Zacks Consensus Estimate of 39 cents. However, the bottom line decreased 49.4% from the year-ago figure of 79 cents.

It is worth noting that unfavorable movements in foreign currencies had an adverse impact of 1 cent per share on earnings.

Revenue Details

Xylem’s revenues of $1,160 million in the quarter under review moved down 13.8% from the year-ago quarter. Organic sales in the quarter declined 12% due mainly to the adverse impacts of the coronavirus outbreak.

Also, the company’s revenues surpassed the Zacks Consensus Estimate of $1,136 million by 2.1%.

Geographically, organic sales fell 15% in the United States, 15% in emerging markets and 4% in Western Europe. Based on end-markets, organic sales in utilities fell 9%, while that in industrial declined 16%. Also, commercial and residential organic sales fell 10% and 15%, respectively.

Orders in the reported quarter fell 11% year over year to $1,232 million. Organically, orders declined 9%.

The company reports net sales under three segments, which are Water Infrastructure, Applied Water, and Measurement & Control Solutions.

The segmental information is briefly discussed below:

Revenues in the Water Infrastructure segment were $501 million, down 10.7% year over year. Organic sales in the quarter decreased 8% year over year. Results suffered from the weakness in utilities and industrial end markets. Business in the U.S. and emerging markets were down 15% and 9%, respectively.

The Applied Water segment generated revenues of $337 million in the second quarter, down 14.5% year over year. Organic sales dipped 13% on a year-over-year basis. Business in commercial, residential and industrial markets was weak in the quarter. Geographically, businesses fell 14% in the United States as well as declined 14% in emerging markets and 12% in Western Europe.

Quarterly revenues of the Measurement & Control Solutions segment were $322 million, down 17.4% year over year. Organic sales decreased 17% year over year. Results suffered from weakness in water, test, energy and SaaS/other end markets. While businesses in the United States declined 16%, that in emerging markets was down 29% and it decreased 5% in Western Europe.

Margin Profile

In the quarter, the company’s cost of sales decreased 11.4% year over year to $726 million. As a percentage of revenues, it represented 62.6% versus 60.9% in the year-ago quarter. Gross profit decreased 17.5% year over year to $434 million, while margin dipped 170 basis points (bps) to 37.4%. Selling, general and administrative expenses dipped 2% to $288 million. Meanwhile, research and development expenses decreased 6.4% to $44 million.

Adjusted operating income in the quarter was $108 million, down 43.8% year over year. Operating margin was down 500 bps to 9.3% due mainly to lower volumes caused by the pandemic.

Balance Sheet and Cash Flow

Exiting the second quarter, Xylem had cash and cash equivalents of $1,577 million, surging 113.4% from $739 million at the end of the last reported quarter. Long-term debt balance increased 49.2% sequentially to $3,031 million.

In the first half of 2020, the company’s proceeds from issuance of long-term debt instruments totaled $987 million.

In the quarter, it generated net cash of $181 million from its operating activities, reflecting an increase of 47.2% from the year-ago comparable quarter. Capital expenditure was $44 million, down 26.7% from the year-ago figure of $60 million. Free cash flow in the quarter was $137 million, up 117.5% from the year-ago quarter.

Shareholder-Friendly Policies

In the first half of 2020, the company paid out dividends amounting to $95 million, reflecting an increase of 9.2% from the year-ago comparable period. Share repurchased amounted to $60 million, up 53.8% year over year.

Outlook

Due to the pandemic-related uncertainties, Xylem refrained from reinstating its projections for 2020. Notably, it withdrew its yearly forecast on Mar 31.

For the third quarter, it expects an organic sales decline of 8-12% year over year. Adjusted operating margin is expected to be 11-11.5%. The projections are better than the results recorded in the second quarter.

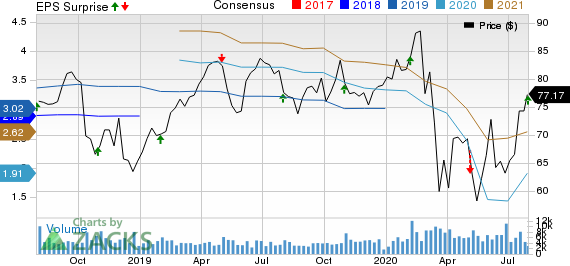

Xylem Inc. Price, Consensus and EPS Surprise

Xylem Inc. price-consensus-eps-surprise-chart | Xylem Inc. Quote

Zacks Rank & Stocks to Consider

The company currently has a market capitalization of $13.4 billion and a Zacks Rank #3 (Hold).

Some better-ranked stocks in the industry are Altra Industrial Motion Corp. AIMC, Chart Industries, Inc. GTLS and Graco Inc. GGG. All these companies currently sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, earnings estimates for these companies improved for the current year. Further, earnings surprise for the last reported quarter was 76.47% for Altra Industrial, 46.51% for Chart Industries and 37.04% for Graco.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Graco Inc. (GGG) : Free Stock Analysis Report

Chart Industries, Inc. (GTLS) : Free Stock Analysis Report

Altra Industrial Motion Corp. (AIMC) : Free Stock Analysis Report

Xylem Inc. (XYL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance