WPX Energy (WPX) Q2 Earnings and Revenues Surpass Estimates

WPX Energy Inc.’s WPX second-quarter 2019 earnings of 9 cents per share surpassed the Zacks Consensus Estimate of 7 cents by 28.6%. The bottom line also increased from 6 cents reported in the year-ago quarter.

The company reported GAAP earnings of 72 cents in the second quarter against a loss of 21 cents in the year-ago period. The difference between GAAP and operating earnings in the reported quarter was due to a one-time gain related to its equity interest in the sale of the Oryx II pipeline project.

Total Revenues

WPX Energy’s quarterly revenues of $695 million beat the Zacks Consensus Estimate of $578 million by 20.3% and improved from the year-ago figure of $430 million by 61.6%.

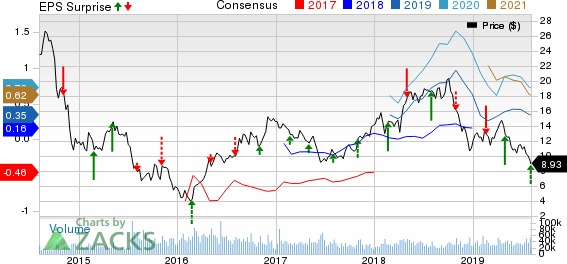

WPX Energy, Inc. Price, Consensus and EPS Surprise

WPX Energy, Inc. price-consensus-eps-surprise-chart | WPX Energy, Inc. Quote

Highlights of the Release

Total production in the second quarter was 159.6 thousand barrels of oil equivalent per day (Mboe/d), up 28% year over year. Liquids volumes accounted for nearly 79% of total production, reflecting the company’s increasing focus on oil.

Oil production in the quarter was 97.9 thousand barrels per day, which was nearly 21% higher than the year-ago level, courtesy of 30% and 25% growth in volumes in Delaware and Williston basins over the past 12 months.

Total expenses were $514 million, up 18.7% from $433 million in the year-ago quarter.

Interest expenses in the reported quarter were $40 million, up 2.6% from $39 million a year ago.

The company initiated a program to repurchase up to $400 million of shares in the next 24 months, which will further increase WPX Energy’s shareholder value.

Realized Prices & Hedges

Realized oil prices in the quarter were $57.42 per barrel, down 9.8% from the year-ago level.

Realized natural gas prices were 88 cents per thousand cubic feet, down 21.4% from a year ago. Realized prices for natural gas liquids were down 41.7% from the year-ago quarter to $12.21 per barrel.

For the remainder of 2019, WPX Energy has 60,500 bbl/d of oil hedged at a weighted average price of $55.29 per barrel. The company also has 110,000 million British thermal units (MMBtu) per day of natural gas hedged at a weighted average price of $3.07 per MMBtu.

Financial Update

Cash and cash equivalents of WPX Energy on Jun 30, 2019 were $109 million compared with $3 million as of Dec 31, 2018.

Its long-term debt on Jun 30, 2019 was $2,157 million, down from $2,485 million at the end of December 2018.

Net cash from operating activities in the first half of 2019 was $634 million compared with $428 million recorded in the comparable year-ago period. During the first six months of 2019, capital expenditure was $774 million compared with $660 million in the comparable prior-year period.

Guidance

Taking into consideration strong production in the first half of the year, WPX Energy made an upward revision in its total production guidance for 2019 to 160-165 Mboe/d from the prior range of 149-161 Mboe/d.

The company now expects 2019 oil production in the range of 101-103 Mboe/d versus the prior guided range of 96-100 Mboe/d.

Capital expenditure for 2019 is expected in the range of $1,100-$1,275 million.

Zacks Rank

Currently, the company carries a Zacks Rank #3 (Hold). You can see the complete list of today's Zacks #1 Rank (Strong Buy) stocks here.

Other Releases

Noble Energy, Inc. NBL incurred an adjusted loss of 10 cents per share in second-quarter 2019, narrower than the Zacks Consensus Estimate of a loss of 13 cents.

EQT Corporation EQT reported second-quarter 2019 adjusted earnings of 9 cents per share against the Zacks Consensus Estimate of a loss of 4 cents.

Cabot Oil & Gas Corporation’s COG second-quarter 2019 earnings per share of 36 cents surpassed the Zacks Consensus Estimate of 33 cents.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

EQT Corporation (EQT) : Free Stock Analysis Report

WPX Energy, Inc. (WPX) : Free Stock Analysis Report

Cabot Oil & Gas Corporation (COG) : Free Stock Analysis Report

Noble Energy Inc. (NBL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance