Why this is the worst time for deficit-financed tax cuts

Mark Zandi is the chief economist at Moody’s Analytics.

I’m no fan of the tax cuts the Trump administration and Republican Congress are trying to jam into law. The cuts won’t help the economy, but they will add to the nation’s debt. Multinational corporations and wealthy taxpayers are clear winners, but it is unclear if small businesses and lower income taxpayers get much if any tax break. The tax code will be simpler for some, but more complex for others.

But I’m guessing you’ve heard all this before. These criticisms of the tax cuts have been well articulated and debated. I won’t rehash them. Instead, let me give you a few less-appreciated reasons why the tax cuts Washington DC is considering are a big mistake.

Lower house prices

The tax cuts will lower house prices in much of the country. Nationwide, the hit to house prices will be as much as 5%, and much greater for higher priced homes, especially in parts of the country where incomes are higher and there are thus a disproportionate number of itemizers, and where homeowners have big property tax bills. The Northeast corridor, South Florida, big Midwestern cities, and the West Coast will suffer the biggest price declines. Counties like Westchester, NY; Cook, IL, and Delaware, PA will see double-digit price declines (see Chart 1).

To connect the dots between the tax law changes and house prices consider that most homebuyers determine how much home they are able to purchase after considering the tax breaks they will receive as homeowners. For those who itemize on their tax returns, this includes the mortgage interest deduction and property taxes. Current house prices thus reflect the value of these tax breaks. In reality, homebuyers don’t do this calculation, but Realtors and mortgage lenders do it for them.

The tax cuts being considered by Congress significantly reduce the value of the mortgage interest deduction by doubling the standard deduction and thus significantly reducing the number of households that itemize and thus take advantage of the mortgage interest deduction. Property tax deductions are also scaled back or eliminated under the tax cut proposals. Also weighing on house prices will be the lower housing demand due to the higher mortgage rates that result from the higher federal budget deficits and debt under the tax cuts.

None of this is to say the mortgage interest and property tax deductions lift homeownership—a selling point others give for these tax breaks. Moreover, prices for lower priced homes in some parts of the country, particularly in more rural and exurban areas where incomes are lower and itemizing less commonplace, should rise modestly if the tax proposals become law.

But all of this is irrelevant to those current homeowners who purchased their homes based on the current tax code and who will be hurt when their homes are worth less.

Bad timing

It is particularly bad timing for deficit-financed tax cuts. This is evident when considering the economic and fiscal backdrop during the last two major tax cuts—the Reagan cuts of the early 1980s and the Bush tax cuts of 2001. Those cuts were bigger than what Congress currently plans, but they became law when the economy was struggling and the fiscal situation substantially better than it is today.

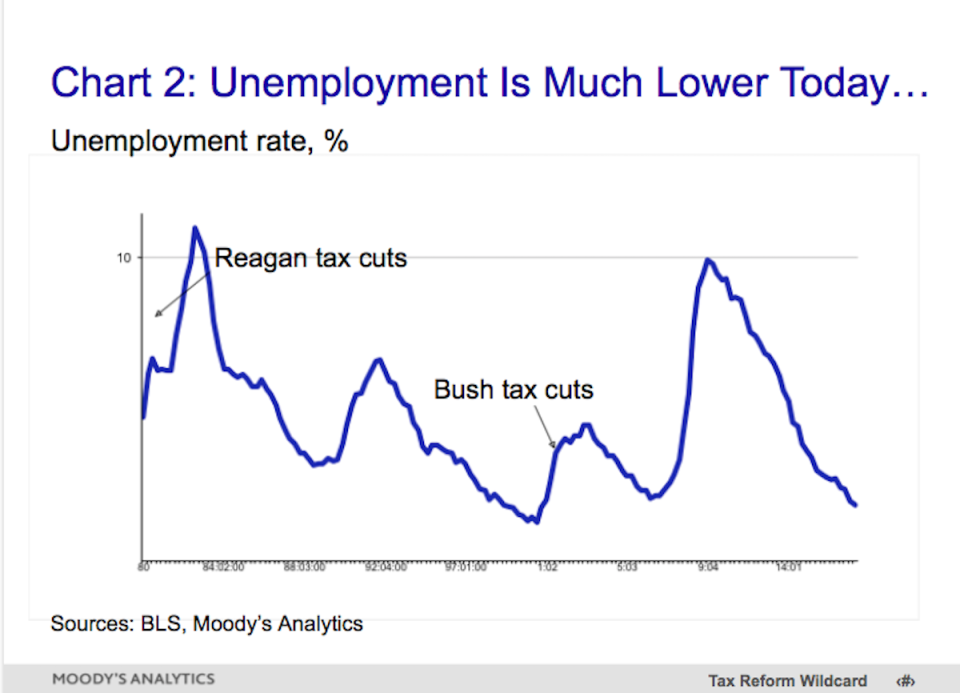

The early 1980s were a time of serious economic stress, with rampant double-digit unemployment and the bursting of the stock market bubble. In 2001, 9/11 pushed the economy into recession. Unemployment today is near 4%, and even with no tax cuts, is widely expected to fall below 4% in coming months, consistent with the lowest unemployment rates in the nation’s history (see Chart 2).

Many businesses are already complaining that they are unable to find qualified workers to fill their record number of open job positions. Inflation is still low, but policymakers at the Federal Reserve believe it is set to accelerate even without a push from a deficit-financed tax cut.

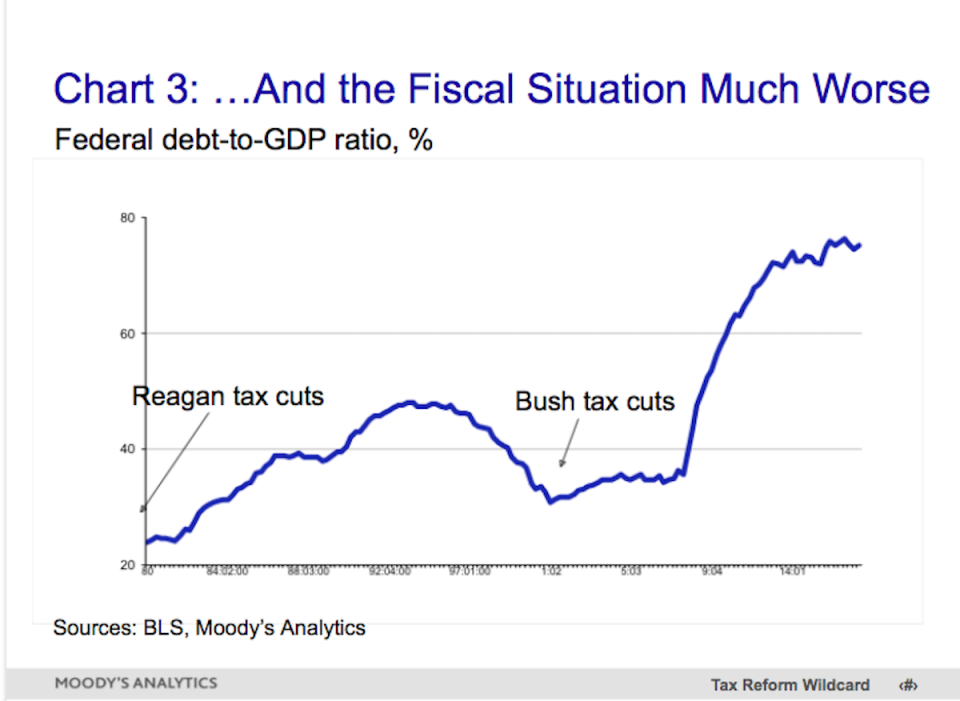

The government’s finances were also much better prior to the Reagan and Bush tax cuts. Tax revenues as a share of GDP were close to a record 19% of GDP, compared with 17% today. Indeed, revenues have averaged almost precisely 17% over the past half century. It is thus difficult to argue that collectively we are over-taxed, at least not by any historical standard.

Debt loads were also much lower prior to past tax cuts—25% of GDP under Reagan and just over 30% under Bush. This compares with over 75% today (see Chart 3). Perhaps even more important, the concern back in the early 2000s was that the country would be running government surpluses and there would be a lack of Treasury securities to trade. Today, the fiscal outlook is dark, according to the Congressional Budget Office, even without a deficit-financed tax cut.

Heightened uncertainty

The tax cuts will create even more uncertainty in the very uncertain tax code. Under Senate rules, tax and spending legislation that passes using the reconciliation process, in which only a simple majority of votes is required, must be deficit neutral by the last year of the 10-year budget horizon. If the Joint Committee on Taxation—the official arbiter of the fiscal impact of tax legislation—shows that there will be a deficit a decade from now, all of the provisions in that legislation expire.

This is very likely the fate of the individual tax cuts. Proponents of the tax cuts say not to worry, as future policymakers will extend the tax cuts. Really? That’s not what happened with the Bush tax cuts, when the bulk of them expired as part of resolving the 2013 fiscal cliff. Uncertainty over how future lawmakers would deal with this tax cliff could also crimp business investment, particularly longer-lived risker types of investment, and broader economic growth as the cliff comes into view.

We can do better

None of this is to say that policymakers should not pass a well-designed tax reform plan. Tax reform that lowers marginal rates, particularly for businesses, but is paid for and does not add to the government’s deficits and debt load will result in stronger sustainable economic growth. This is the clear message in the best recent research from the JCT, Congressional Research Service, and academia.

Perhaps the most relevant research is a JCT 2005 study that considered a 20% cut in the federal corporate tax rate under the assumption that the cut was deficit-financed, and also assuming that it was paid for by cuts to government spending. In the long run consistent with a 10-year budget horizon, a paid-for corporate tax rate cut lifts real GDP by almost 1%, but a deficit-financed tax cut by only 0.3%.

Even under the best-designed tax plans, the lift to GDP in the long run is still relatively modest, at least compared with the expectations of those who strongly advocate for tax cuts to support long-term economic growth. Paid-for, well-designed tax cuts are a plus for the economy, but they are not an elixir.

This brings me back to the current tax cuts. As now proposed, they are poorly designed and not an economic plus. If tax cut efforts fail, it will be an opportunity lost, but it will be better than passing large deficit-financed tax cuts. Good tax reform is very difficult to do, and the tax proposals policymakers are currently considering do not get it done.

Read more:

Zandi: This is a rip-roaring labor market

Moody’s Analytics Chief Economist: Why the Republican tax plan is set up to fail

Yahoo Finance

Yahoo Finance