Workday (WDAY) Q3 Earnings Beat on Solid Revenues, Shares Up

Workday Inc. WDAY reported strong third-quarter fiscal 2023 results (ended Oct 31, 2022), with the bottom line and top line beating the consensus estimate. With solid demand trends, the company is confident about its growth opportunities for fiscal 2023. It plans to focus on higher investments in key industries and innovation efforts to expand its footprint within the partner ecosystem.

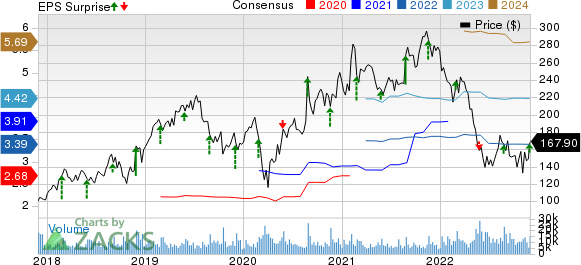

Backed by the healthy quarterly performance, management updated guidance for fiscal 2023. These buoyed investor sentiments as share prices soared 17.2% post earnings release to close at $167.90 on Nov 30, 2022.

Quarter Details

Net loss in the reported quarter was $74.7 million or a loss of 29 cents per share against net income of $43.4 million or 17 cents per share in the prior-year quarter. Despite top-line growth, higher operating expenses led to a loss during the quarter. Non-GAAP net income was $257.9 million or 99 cents per share compared with $286.6 million or $1.10 per share in the prior-year quarter. The bottom line beat the Zacks Consensus Estimate by 15 cents.

Workday, Inc. Price, Consensus and EPS Surprise

Workday, Inc. price-consensus-eps-surprise-chart | Workday, Inc. Quote

Total revenues in the quarter improved to $1,599.1 million from $1,327.3 million in the prior-year quarter, driven by higher digital transformation initiatives across Finance and HR domains in tune with the evolving market conditions. The top line outpaced the Zacks Consensus Estimate of $1,580 million. Subscription services revenues were $1,432.4 million compared with $1,171.5 million a year ago, while Professional services revenues increased to $166.7 million from $155.7 million in the prior-year quarter.

Operating Details

Operating loss during the quarter was $26.3 million against operating income of $23.9 million in the prior-year quarter. Non-GAAP operating income was $314.2 million for an operating margin of 19.7% compared with respective tallies of $332.2 million and 25% in the year-earlier quarter.

Cash Flow & Liquidity

During the first nine months of fiscal 2023, WDAY generated $962.7 million of cash from operating activities compared with $1,035.6 million in the prior-year period. As of Oct 31, 2022, the company had cash and cash equivalents and marketable securities of $5,492.1 million with long-term debt of $2,975 million.

Guidance

With continued momentum in its business, the company updated its earlier guidance for fiscal 2023. Subscription revenues for the fiscal year are currently projected to be in the band of $5,555-$5,557 compared with earlier expectations of $5,537-$5,557 million. Professional services revenues are expected to be around $650 million. Non-GAAP operating margin is projected to be 19.2%, up from prior expectations of 19%.

Zacks Rank & Stocks to Consider

Workday currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

TESSCO Technologies Incorporated TESS, sporting a Zacks Rank #1, delivered an earnings surprise of 126.1%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 44.3% since November 2021.

TESSCO offers products to the industry’s top manufacturers in mobile communications, Wi-Fi, wireless backhaul and related products. With more than three decades of experience, it delivers complete end-to-end solutions to the wireless industry.

Harmonic Inc. HLIT, carrying a Zacks Rank #2 (Buy), delivered an earnings surprise of 79.3%, on average, in the trailing four quarters. Earnings estimates for Harmonic for the current year have moved up 48.6% since March 2021.

Harmonic provides video delivery software, products, system solutions, and services worldwide. With more than three decades of experience, it has revolutionized cable access networking via the industry's first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit internet service to consumers' homes and mobile devices.

AudioCodes Ltd. AUDC, sporting a Zacks Rank #1, is likely to benefit from the secular tailwinds related to IP-based communications. Incorporated in 1992 and headquartered in Lod, Israel, it offers advanced communications software, products and productivity solutions for the digital workplace. It has a long-term earnings growth expectation of 9%.

AudioCodes aims to leverage its long-term partnership with Microsoft to further strengthen its market position. It is also likely to benefit from its continued focus on high-margin businesses.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Harmonic Inc. (HLIT) : Free Stock Analysis Report

Workday, Inc. (WDAY) : Free Stock Analysis Report

AudioCodes Ltd. (AUDC) : Free Stock Analysis Report

TESSCO Technologies Incorporated (TESS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance