Wish You Were Here: How Perisson Petroleum (CVE:POG) Shareholders Made A Stonking Gain Of 1100%

It hasn't been the best quarter for Perisson Petroleum Corporation (CVE:POG) shareholders, since the share price has fallen 27% in that time. But that isn't a problem when you consider how the share price has soared over the last year. In fact, it is up 1100% in that time. So we wouldn't blame sellers for taking some profits. The real question is whether the fundamental business performance can justify the strong increase over the long term.

We love happy stories like this one. The company should be really proud of that performance!

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

View our latest analysis for Perisson Petroleum

With just CA$2,400,410 worth of revenue in twelve months, we don't think the market considers Perisson Petroleum to have proven its business plan. So it seems that the investors focused more on what could be, than paying attention to the current revenues (or lack thereof). For example, they may be hoping that Perisson Petroleum finds fossil fuels with an exploration program, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. You should be aware that there is always a chance that this sort of company will need to issue more shares to raise money to continue pursuing its business plan. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Some Perisson Petroleum investors have already had a taste of the sweet taste stocks like this can leave in the mouth, as they gain popularity and attract speculative capital.

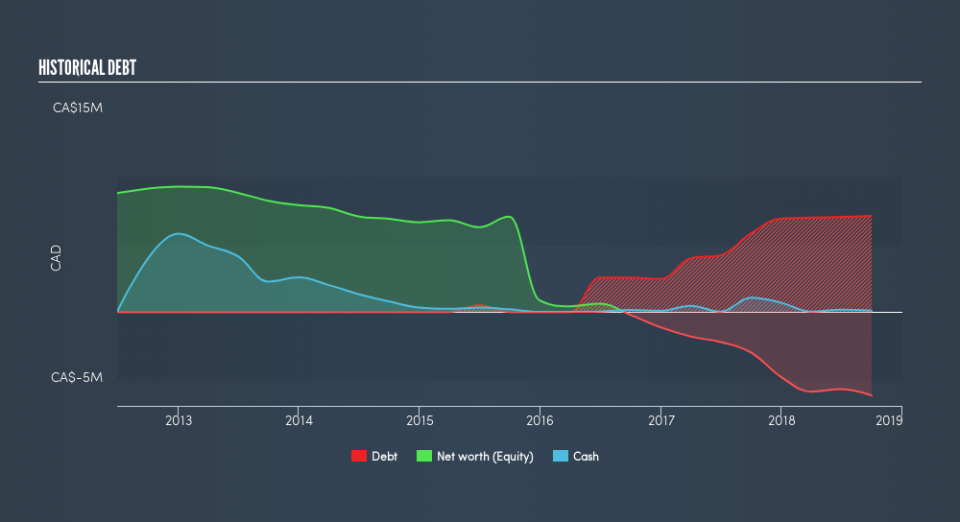

Our data indicates that Perisson Petroleum had CA$12,920,077 more in total liabilities than it had cash, when it last reported in September 2018. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 1100% in the last year, but we're happy for holders. It's clear more than a few people believe in the potential. You can see in the image below, how Perisson Petroleum's cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

A Different Perspective

Perisson Petroleum boasts a total shareholder return of 1100% for the last year. Unfortunately the share price is down 27% over the last quarter. Shorter term share price moves often don't signify much about the business itself. You could get a better understanding of Perisson Petroleum's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

Yahoo Finance

Yahoo Finance