Why Has Southwestern Energy (SWN) Risen 3% Since Q1 Earnings?

Since the first-quarter results were announced on Apr 30, Southwestern Energy Company SWN has seen a 3% rally in share price. The upstream energy firm’s better-than-expected quarterly earnings and favorable second-quarter production guidance despite the coronavirus pandemic lent support to the stock.

Q1 Earnings Beat

Southwestern Energy reported first-quarter 2020 adjusted earnings of 10 cents per share, beating the Zacks Consensus Estimate of 7 cents. However, the bottom line declined from the year-ago profit of 27 cents.

Quarterly operating revenues of $592 million missed the Zacks Consensus Estimate of $641 million and declined from $990 million in first-quarter 2019.

The earnings beat was supported by higher gas equivalent production, partially offset by lower average realized commodity prices.

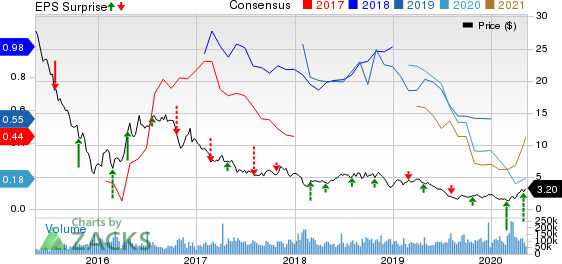

Southwestern Energy Company Price, Consensus and EPS Surprise

Southwestern Energy Company price-consensus-eps-surprise-chart | Southwestern Energy Company Quote

Total Production Increases

The company’s total first-quarter production increased to 201 billion cubic feet equivalent (Bcfe) from 182 Bcfe a year ago. Gas production in the quarter was 156 Bcf compared with the year-ago level of 143 Bcf.

Moreover, oil production surged to 1,399 thousand barrels (MBbls) from 854 MBbls in the year-ago quarter. Natural gas liquids production in the quarter under review was recorded at 6,128 MBbls, higher than the year-ago level of 5,603 MBbls. It is to be noted that almost 77.6% of its volume mix constituted of natural gas.

Average Realized Prices Fall

The company’s average realized gas price in the quarter, excluding derivatives, fell to $1.53 per thousand cubic feet (Mcf) from $2.95 a year ago. Oil was sold at $36.72 per barrel compared with the year-earlier level of $45.48. Natural gas liquids were sold at $8.16 per barrel, lower than $14.45 in the year-ago period.

Expenses

On a per-Mcfe basis, lease operating expenses were 96 cents compared with the prior-year level of 90 cents. However, general and administrative expenses per unit of production were 11 cents, down from 19 cents in the year-ago quarter.

Financials

Southwestern Energy’s total capital expenditure during the first quarter was $86 million.

As of Mar 31, 2020, the company’s cash and cash equivalents were $5 million. Long-term debt was $2,279 million, which represents a debt-to-capitalization of 58.8%.

Guidance

The upstream energy player expects production volumes in the June quarter of 2020 to be mostly unaffected, thanks to improvement in well performance.

Zacks Rank & Other Stocks to Consider

Southwestern Energycurrently carries a Zacks Rank #2 (Buy). Other prospective stocks in the energy sector are Murphy USA Inc MUSA, Key Energy Services, Inc. KEGX and CNX Resources Corporation CNX. While Key Energy sports a Zacks Rank #1 (Strong Buy), Murphy USA and CNX Resources carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Murphy USA is likely to see earnings growth of 7% in the next five years.

Key Energy is likely to see bottom-line growth of 97.2% in 2020.

CNX Resources has witnessed upward estimate revisions for 2020 bottom line in the past 60 days.

The Hottest Tech Mega-Trend of All

Last year, it generated $24 billion in global revenues. By 2020, it's predicted to blast through the roof to $77.6 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Southwestern Energy Company (SWN) : Free Stock Analysis Report

CNX Resources Corporation (CNX) : Free Stock Analysis Report

Murphy USA Inc (MUSA) : Free Stock Analysis Report

Key Energy Services Inc (KEGX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance