Why Pier 1 Stock Shed 20% in January

What happened

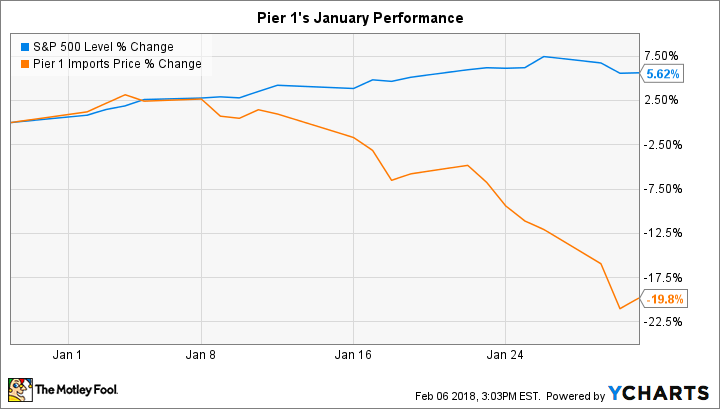

Home furnishings retailer Pier 1 (NYSE: PIR) trailed the market by a wide margin last month, falling 20% compared to a 6% increase in the S&P 500, according to data provided by S&P Global Market Intelligence.

The plunge follows a brutal 2017 for shareholders, who saw their stock price fall by more than 50%.

So what

January's decline came as investors prepared for the anticipated news that this past holiday season was a tough one for the struggling retailer. Comparable-store sales declined in the fiscal third quarter, but the more worrying trend was that Pier 1 noticed a considerable drop in customer traffic during the first two weeks of December.

Image source: Getty Images.

Now what

That traffic slump makes it likely Pier 1 will report weak sales and deteriorating profit margins when it announces fiscal fourth-quarter results in the coming weeks. That poor performance should add a sense of urgency to the strategic review that new CEO Alasdair James is taking right now.

Together with a freshly appointed chief financial officer, Nancy Walsh, James is working out options for keeping the business healthy as it adjusts to a rapidly shifting consumer landscape. While the stock might look cheap today, given its 80% decline over the past five years, investors might want to wait for the results of that strategic review before buying into shares.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance