Why Overstock.com, Inc. Shares Fell 47% in the 1st Half of 2018

What happened

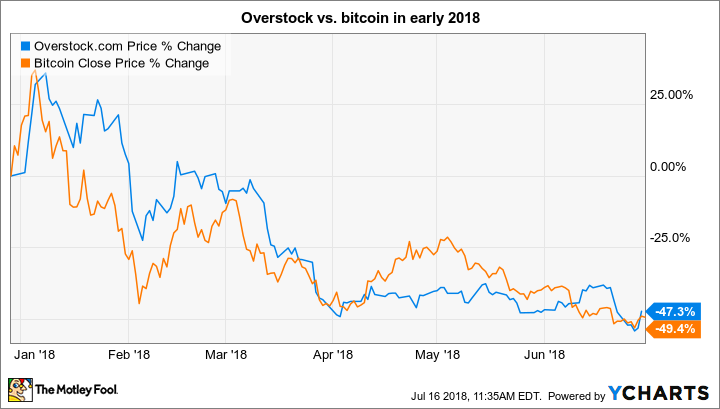

Shares of Overstock.com (NASDAQ: OSTK) fell 47.3% in the first half of 2018, according to data from S&P Global Market Intelligence. The e-tailer's troubles had almost nothing to do with online retailing.

So what

Overstock shares skyrocketed in 2017 thanks to the company's efforts to make a business out of cryptocurrencies and blockchain technology. That surge continued into the first week of 2018, where cryptocurrency prices still appeared to have some fresh boosts coming their way.

But when bitcoin and other digital coins ran out of rocket fuel, so did Overstock. The company also presented two disappointing earnings reports along the way, but the market largely shrugged them off and continued to tie Overstock's share prices very closely to the ups and downs of leading cryptocurrencies:

Now what

Overstock CEO Patrick Byrne is still taking his company deeper into the blockchain market, and maybe that's all for the best now that Wayfair (NYSE: W) has emerged as a crushing rival in Overstock's traditional playground of online home goods retailing. Overstock's tZERO securities trading platform has found some third-party capital to back its long-term plans, but it's still an unprofitable and risky business.

These days, Overstock's shares can be seen as an indirect bet on blockchain technologies, which would be fine if it were tied to a financially stable business platform. But Overstock is unprofitable as a whole, leaving more risk than promises of future rewards in this volatile stock.

Image source: Getty Images.

More From The Motley Fool

Anders Bylund has no position in any of the stocks mentioned, but he does hold a fraction of a bitcoin token. The Motley Fool owns shares of and recommends Wayfair, but has no position in any other stocks or cryptocurrencies mentioned here. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance