Why LendingClub Stock Fell 14% in February

What happened

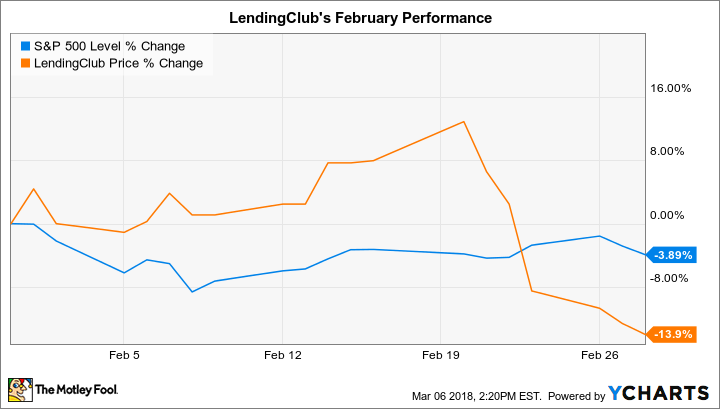

Shares of LendingClub (NYSE: LC) trailed the market last month, dropping 14% compared to a 4% decrease in the S&P 500, according to data provided by S&P Global Market Intelligence.

The stock had been up by over 10% but dove late in the month to end 14% lower.

So what

February's slump was driven by investors' harsh reaction to LendingClub's fourth-quarter earnings report. In that announcement, the specialty financial services giant posted revenue that was just below the guidance management had issued three months earlier. Loan originations were flat compared to the prior quarter but up 23% year over year.

Image source: Getty Images.

Its net loss, meanwhile, ballooned to $92 million from $7 million a year ago, but only thanks to a one-time litigation settlement expense. Adjusted earnings held steady at roughly $20 million.

Now what

CEO Scott Sanborn and his team are glad to have put what they called the "rebuilding" year of 2017 behind them. Their 2018 outlook calls for growth to speed back up, rising to a 20% rate from the 15% boost they managed last year. LendingClub is projecting a third consecutive year of net losses, though, which helps explain why investors remain cautious about this volatile stock.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance