Why investors need to watch Europe right now

By David Nelson, Yahoo Finance Contributor

We’re coming into the heart of earnings season so now we get down to the blocking and tackling of market behavior. 10% of the S&P 500 (SPY) reports this week but the bulk comes in the last 2 weeks of the month.

The 3 Musketeers of Banking — JP Morgan (JPM) Wells Fargo (WFC) and Bank of America (BAC) — reported Friday as analysts and investors rushed to digest the information before setting off on a long Martin Luther King Holiday weekend. Earnings came in pretty much as expected but I think all eyes were on Wells Fargo as they try to move beyond the phony account scandal and prepare themselves for a rising interest rate environment.

In the days and weeks ahead we are going to learn more about the Financial Sector (XLF) rally from banks that miss earnings than from those who meet or beat expectations. If the majority of banks that miss recover quickly from the knee jerk reaction to sell, it will confirm the focus has shifted to the benefit of future rate hikes along with a rollback of regulatory overreach. In other words investors will get a pass.

Europe

Of more concern are some of the events taking place in Europe. No, I don’t mean Davos. The global elite will fly in on their Jets to lecture the rest of us about income equality but I expect little to come out of this year’s World Economic Forum to drive market direction.

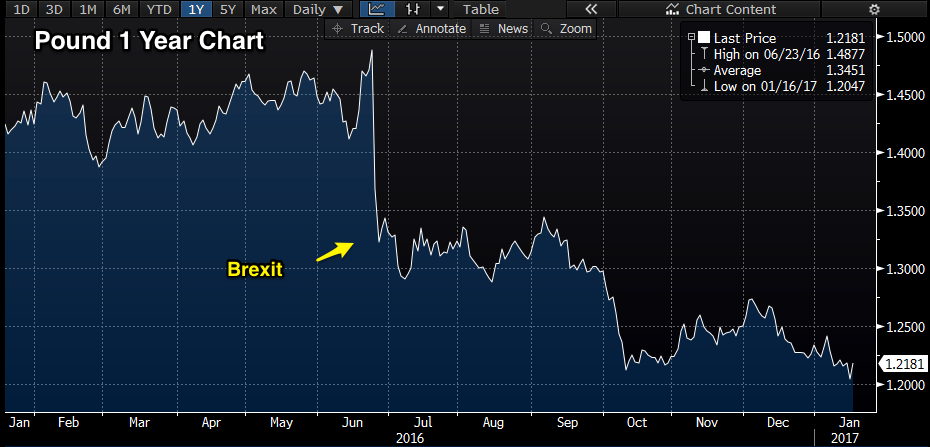

If anyone had any doubts that the UK was going to follow through with its exit from the EU those hopes were dashed over the weekend. According to the New York Times some news outlets were briefed by Downing Street pointing to a “hard Brexit.”

Prime Minister Theresa May is on record saying just a week ago; “We are leaving. We are coming out. We are not going to be a member of the E.U. any longer. We will be able to have control of our borders, control of our laws.“

On Monday the Pound approached post-Brexit lows at 1.20 along with a weak Euro. Both are getting a lift Tuesday on the heels of remarks from the US president-elect regarding the border adjustment in the GOP tax plan. Never the less Euro/Dollar parity is a matter of “when” not “if,” in my humble opinion.

Adding to the concern the French Elections are just a couple of months away against a backdrop of rising populist sentiment.

It should also be noted that Angela Merkel has decided not to attend Davos for the second year in a row. I don’t find it surprising at all that she has decided to distance herself in the wake of Brexit and the truck attack in Berlin.

A few years ago when some like yours truly were predicting the ultimate demise of the Euro, most were saying “will never happen.” Today that voice is getting louder as some hedge funds start to prepare for the end and articles predicting the demise of the currency are hitting the main stream press. I’ll repeat what I said as far back as 2011: “You can’t have a common currency without a common government.”

Can this man save the EU

Rising in popularity as the April 23rd vote in France approaches is Emmanuel Macron, former economy minister who has never held elective office. He’s running on a strong Pro EU platform that for the moment seems to speak to a younger audience. Speaking to a packed house of 5000, he said the following: “We need Europe because Europe makes us bigger, because Europe makes us stronger.”

The election is approaching and the battle lines are drawn but I’ll stand by my comments. Dysfunctional politics and a deaf ear to the rising tide of discontent will likely push the currency to the edge of the Abyss.

*At the time of this article funds managed by David Nelson, CFA were long JPM, BAC, WFC & SPY

Yahoo Finance

Yahoo Finance