Why This Hot Solar Stock Is Just Getting Started

A year ago, Enphase Energy (NASDAQ: ENPH) was on the brink of collapse. The company was reporting unsustainable losses and revenue was falling as competition in the module-level electronics business picked up.

Management has started to turn its business around in the past year, and the stock has responded as a result. Shares are up 463% in a year and I don't think the run higher is done.

Image source: Getty Images.

Enphase's big turnaround

Enphase's microinverter business was once one of the hottest in the solar industry, but that changed when SolarEdge Technologies' power optimizers started to take over the market. Power optimizers were cheaper than microinverters, and in a world where costs are key, they left microinverters in the dust. But cost reductions and improved technology have helped Enphase turn around some of those losses.

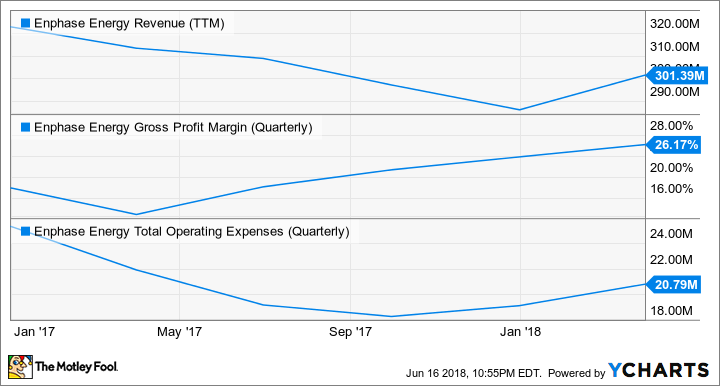

Revenue, gross margin, and operating expenses are the three factors I think investors need to watch in Enphase Energy's turnaround. Improvement in any of these metrics can improve the bottom line, but if all three are getting better, the leverage for the business is enormous.

You can see in the chart below that revenue is still falling year over year, but it's stabilized and showed decent sequential growth in the first quarter of 2018. Gross margin jumped from 12.9% a year ago to 26.2% and is steadily improving.

ENPH Revenue (TTM) data by YCharts.

Operating expenses are also coming down, and if we looked back into 2016, costs are down about $10 million annually. I wouldn't expect further cuts to be dramatic, but if operating expenses can stabilize long term, it would help profitability for the business.

The seeds have been planted for Enphase Energy's turnaround. Now, the company needs to keep pushing revenue and margins higher to prove that it'll be a long-term winner.

What's next

The next big impact on Enphase Energy's turnaround will be a recent acquisition. The company recently bought SunPower's (NASDAQ: SPWR) microinverter business for $25 million in cash and 7.5 million shares of stock in a deal that eliminates a competitor and adds a customer at the same time.

Enphase will actually shut down SunPower's microinverter business after acquiring it and will become its microinverter supplier with its IQ line of microinverters. The deal is expected to add $60 million to $70 million of annualized revenue by the second half of 2019 with a 33% to 35% gross margin. As you can see above, this will add to gross margin and be incremental to revenue as well. This deal alone could add enough margin to bring the company to net profitability.

The next phase of growth could be driven by energy storage, which is an area where inverter manufacturers have an inherent advantage. As the component that interacts between solar panels, a home, and the grid, inverters take a natural role as the "brains" of a solar system. That's why they're the natural fit for energy storage.

Enphase's energy storage solution is called the AC Battery and it integrates with the company's inverters and monitoring systems. It's early in the industry's growth, but if the product can gain some traction, it would be a huge win for the company. GTM Research estimates that energy storage in the U.S. alone will grow from a $302 million market in 2017 to a $3.77 billion market in 2023, with over half of that revenue coming from residential and commercial projects where Enphase sells microinverters. Even a small share of that market could have a huge impact on the company.

Why Enphase Energy is a buy

Enphase's rising stock price has led to a market cap of $512 million, which may not look cheap for a company still losing money, but it is increasing margins, growing sales, and holding operating costs steady. If it can continue doing that in the growing global residential solar business, it has a bright future ahead. I think this stock's run higher is just getting started.

More From The Motley Fool

Travis Hoium owns shares of SunPower. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance