Why a Hold Strategy is Apt for IQVIA Holdings (IQV) Stock Now

IQVIA Holdings Inc. IQV has an impressive Growth Score of A. This style score condenses all the essential metrics from a company’s financial statements to get a true sense of the quality and sustainability of its growth. The stock gained 4.7% in the past month.

The company has an expected long-term earnings per share (three to five years) growth rate of 14.8%. Further, earnings are anticipated to register growth of 12.4% and 13.6% in 2022 and 2023, respectively.

Factors That Auger Well

IQVIA’s enormous treasure trove of information is a distinguishing asset and also perhaps a big barrier to entry for competitors. The company has a huge collection of healthcare information that encompasses more than one billion comprehensive, longitudinal, non-identified patient records across sales, prescription and promotional data, electronic medical records, medical claims, genomics, and social media.

IQVIA’s addressable market, with a size of around $260 billion, consists of outsourced research and development, real-world evidence, and connected health, and technology-enabled clinical and commercial operations markets. The company aims to expand and penetrate into these markets by innovating and improving its offerings using its information, advanced analytics, transformative technology and significant domain expertise.

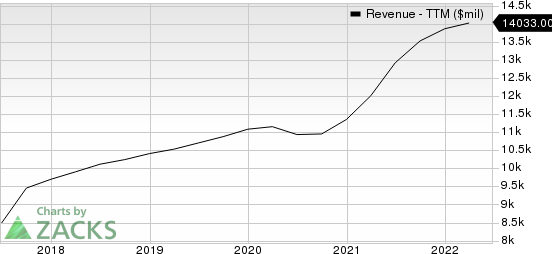

IQVIA Holdings Inc. Revenue (TTM)

IQVIA Holdings Inc. revenue-ttm | IQVIA Holdings Inc. Quote

IQVIA has a consistent record of share repurchase. In 2021, 2020 and 2019, the company had repurchased shares worth $406 million, $447 million and $949 million, respectively. Such moves not only instill investors’ confidence but also positively impact earnings per share.

Some Risks

IQVIA’s current ratio at the end of first-quarter 2022 was pegged at 0.93, lower than the current ratio of 1.15 reported at the end of the prior-year quarter. Decreasing current ratio is not desirable as it indicates that the company may have problems meeting its short-term obligations.

Zacks Rank and Stocks to Consider

IQVIA currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Business Services sector that investors can consider are Cross Country Healthcare CCRN, Gartner IT and Avis Budget CAR, each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cross Country Healthcare has an expected earnings growth rate of 54.2% for the current year. CCRN has a trailing four-quarter earnings surprise of 29.2%, on average.

Cross Country Healthcare has a long-term earnings growth rate of 6.9%.

Gartner’s shares have gained 1.2% in the past year. IT delivered a trailing four-quarter earnings surprise of 24.2%, on average.

The Zacks Consensus Estimate for Gartner's current-year earnings has moved up 13.6% in the past 90 days.

Avis Budget has an expected earnings growth rate of 59.8% for the current year. CAR delivered a trailing four-quarter earnings surprise of 102.1%, on average.

Avis Budget has a long-term earnings growth rate of 19.4%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance