Why Should You Hold Omnicom (OMC) Stock in Your Portfolio?

Omnicom Group Inc. OMC has an impressive Growth Score of B. This style score condenses all the essential metrics from the company’s financial statements to get a true sense of quality and sustainability of its growth.

We believe that with a market cap of $11.8 billion and long-term (three-five years) expected earnings per share growth rate of 7%, Omnicom is a stock that investors should retain in their portfolios.

What’s Benefiting the Company?

Consistency and diversity of operations, along with increased focus on delivering consumer-centric strategic business solutions ensure Omnicom’s long-term profitability. To mitigate the impacts of the coronavirus outbreak on its business, the company has transitioned to a global work-from-home system and implemented business-continuity plans.

Although many companies across diverse sectors have suspended dividend payouts amid the coronavirus crisis, Omnicom remains one of those few that are sailing through the tough economic time and maintaining dividend payouts. The company announced quarterly dividends of 65 cents per share in May and July.

Omnicom has a track record of consistent dividend payment. It had paid $571.2 million, $544.5 million and $523.4 million in dividends during 2019, 2018 and 2017, respectively.

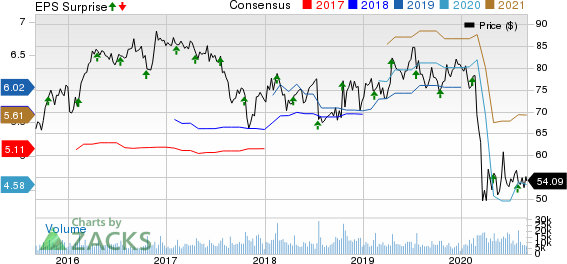

Omnicom Group Inc. Price, Consensus and EPS Surprise

Omnicom Group Inc. price-consensus-eps-surprise-chart | Omnicom Group Inc. Quote

Hurdles to Counter

Omnicom’sfinancial performance is expected to remain under temporary pressure because of a drop in business activities due to the coronavirus pandemic. The company’s earnings and revenues declined 45.2% and 24.7% respectively, in second-quarter 2020.

Omnicom’s debt-to-capital ratio of 0.71 at the end of the second quarter was higher than the previous quarter’s 0.68. Increasing debt-to-capitalization ratio indicates that the proportion of debt to finance the company’s assets is on the rise.

Zacks Rank and Stocks to Consider

Omnicom currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the broader Zacks Business Services sector are BG Staffing BGSF, CoreLogic CLGX and Sykes Enterprises SYKE, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Long-term earnings (three to five years) growth rate for BG Staffing, CoreLogic and Sykes Enterprise is estimated at 20%, 12% and 8%, respectively.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Sykes Enterprises, Incorporated (SYKE) : Free Stock Analysis Report

CoreLogic, Inc. (CLGX) : Free Stock Analysis Report

BG Staffing Inc (BGSF) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance