Why Healthcare REITs HCP, Omega Healthcare, and CareTrust Jumped Double Digits in January

What happened

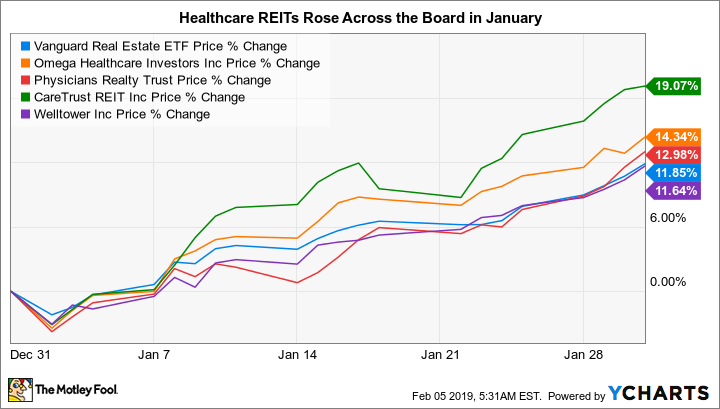

Shares of CareTrust REIT, Inc. (NASDAQ: CTRE) rose an impressive 19% in the month of January, according to data provided by S&P Global Market Intelligence. That's a huge gain in a very short period of time for a real estate investment trust, an asset class focused on passing income to investors. But it wasn't the only healthcare-focused REIT to see some upside at the start of 2019.

Image source: Getty Images.

HCP (NYSE: HCP) and Physicians Realty Trust (NYSE: DOC) both advanced roughly 13%, while Omega Healthcare Investors (NYSE: OHI) jumped a little over 14%. Ventas (NYSE: VTR) and Welltower (NYSE: WELL) joined the party, too, up 10% and 11%, respectively.

So what

Each of these healthcare REITs has a slightly different story behind it. For example, Omega is focused on the nursing-home space. That's been a rough market, as changes in third-party payments, specifically from the U.S.-government-sponsored healthcare system, have been in flux. That said, management has done an excellent job of navigating through the problem while continuing to reward investors.

At the other end of the spectrum is Physicians Realty, which is largely focused on owning medical office buildings. This segment of the healthcare REIT space has been doing much better than others lately. This is why the largest and most diversified healthcare REIT players Ventas, Welltower, and HCP have been focusing on this class, as well. In fact, Ventas and HCP both jettisoned nursing-home assets not too long ago so they could place greater emphasis on medical offices and research facilities.

All in all, the advances here were widespread and it didn't really matter which niche of the healthcare sector a REIT was focused on. Moreover, none of the REITs here enacted any material change in their businesses: On Jan. 31, they were doing the same thing they were doing on Jan. 1. The difference was investor sentiment, which ended 2018 in a very bad place but started 2019 on an ebullient note:

To put a number on that, Vanguard Real Estate ETF, a proxy for the REIT sector, advanced roughly 12% in January. That's about in line with the performance of most of the healthcare REITs here. The only standout, in the end, was CareTrust, which is heavily weighted toward nursing homes but has more of a growth focus. It has expanded its business aggressively since its initial public offering in 2014, taking advantage of the nursing-home downturn to diversify its operator exposure and support rapid dividend growth. It makes logical sense that investors shifting toward a risk-on mentality would find CareTrust a little more appealing than less aggressive REITs.

Now what

The takeaway here is that you shouldn't get too caught up in the advance of any individual healthcare REIT. Nothing in the sector changed markedly. Nothing is particularly different about any of these individual REITs, and they basically tracked the overall REIT sector higher. The impetus for that rise, meanwhile, was investor sentiment turning positive as the new year got underway. Yes, some REITs here are better-positioned than others, but that's not new information. Simply put, a rising tide in January lifted all the healthcare REIT boats.

More From The Motley Fool

Reuben Gregg Brewer owns shares of Ventas. The Motley Fool owns shares of CareTrust REIT and Physicians Realty Trust. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance