Why Is Goldcorp (GG) Down 1.5% Since its Last Earnings Report?

It has been about a month since the last earnings report for Goldcorp Inc. GG. Shares have lost about 1.5% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is GG due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Goldcorp's Q1 Earnings and Revenues Miss Estimates

Goldcorp reported net earnings of $67 million or 8 cents per share for first-quarter 2018, down from $170 million or 20 cents recorded a year ago. Earnings per share missed the Zacks Consensus Estimate of 11 cents.

Goldcorp recorded revenues of $846 million in the first quarter, down roughly 4.1% year over year. The figure also missed the Zacks Consensus Estimate of $868.5 million.

Gold sales went down around 9.4% year over year to 585,000 ounces and production fell 9.9% to 590,000 ounces.

AISC were $810 per gold ounce, up roughly 1.3% year over year.

Mining Highlights

At the Penasquito mine, gold production was 98,000 ounces, marking a decrease of 28.5% year over year from 137,000 ounces. AISC was $132 per ounce, down 66.2% from $391 in the year-ago quarter.

At the Cerro Negro in Argentina, gold production went up 24.2% to 118,000 ounces. AISC was $600 per ounce compared with $651 recorded in the year-ago quarter.

At the Pueblo Viejo mine, gold production was 94,000 ounces, down from 95,000 ounces a year ago. AISC was $591 per ounce compared with $541 in the year-ago quarter.

Financial Position

Goldcorp’s cash and cash equivalents fell 27.2% year over year to $123 million. At the end of first quarter, the company had net debt and adjusted net debt of $2.3 billion and $2.1 billion, respectively.

The company recorded operating cash flow of $271 million for the first quarter compared with $227 million a year ago.

Outlook

Goldcorp expects gold production of 2.5 million ounces (+/- 5%) for 2018, unchanged from prior guidance. AISC has been projected to be roughly $800 per ounce (+/- 5%), also consistent with prior forecast.

Goldcorp stated that its program to achieve $250 million of sustainable annual efficiencies by the middle of this year remains on track. Goldcorp further expects cost reductions at Red Lake and productivity improvements at Cerro Negro to successfully extend the program beyond $250 million of annual sustainable efficiencies in the second half of this year. The company has achieved $210 million at the end of the first quarter.

Goldcorp expects sustaining capital expenditure to be $550 million for 2018.

How Have Estimates Been Moving Since Then?

It turns out, fresh estimates flatlined during the past month. There has been one revision higher for the current quarter compared to one lower.

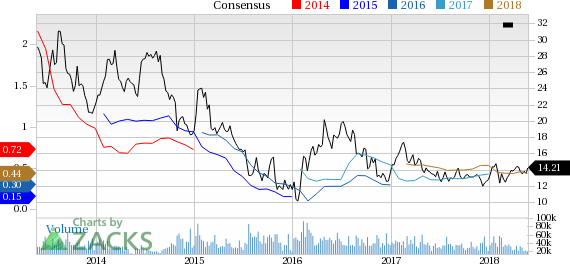

Goldcorp Inc. Price and Consensus

Goldcorp Inc. Price and Consensus | Goldcorp Inc. Quote

VGM Scores

At this time, GG has an average Growth Score of C, though it is lagging a bit on the momentum front with a D. Following the exact same course, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for growth based on our styles scores.

Outlook

GG has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Goldcorp Inc. (GG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance