Why Is Gap (GPS) Up 2.4% Since Its Last Earnings Report?

A month has gone by since the last earnings report for The Gap, Inc. GPS. Shares have added about 2.4% in that time frame.

Will the recent positive trend continue leading up to its next earnings release, or is GPS due for a pullback? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

Gap Q1 Earnings Miss, Revenues Top Estimates

Gap reported lower-than-expected earnings in first-quarter fiscal 2018. However, revenues outpaced the Zacks Consensus Estimate. With this, the company marked its sixth consecutive revenues beat, while earnings lagged estimates after four straight quarters of positive surprises. Further, management reiterated guidance for fiscal 2018.

Q1 Highlights

In the fiscal first quarter, Gap’s earnings of 42 cents per share missed the Zacks Consensus Estimate of 45 cents. However, the bottom-line figure improved 16.7% from 36 cents in the year ago. Quarterly earnings per share reflect a favorable impact from the 53rd week in fiscal 2017.

Net sales grew 10% to $3,783 million and also fared better than the Zacks Consensus Estimate of $3,608 million. We note that the company adopted the new revenue recognition standard ASC 606 in the quarter. Excluding the effect from the adoption of new revenue recognition standard, the top line rose 6% year over year. Also, foreign currency translations aided revenue growth by $40 million.

The company’s comparable store sales (comps) inched up 1% versus 2% increase in the year-ago period. Comps continued to gain from robust Old Navy performance, which was fueled by strength in category and improved traffic. Comps for both Old Navy and Banana Republic were up 3%, while the Gap brand’s comps fell 4%.

Margins

Gap’s gross profit rose 10% to $1,427 million, while gross margin contracted 20 basis points (bps) to 37.7%. Excluding the effect of the adoption of the revenue recognition standard, gross profit grew 3%, while gross margin contracted 120 bps to 36.7% mainly owing to the company’s namesake brand.

Furthermore, operating income declined 9.8% to $229 million, with operating margin contracting 130 bps to 6.1%. Excluding the effect of the adoption of the revenue recognition standard, operating margin fell 110 bps to 6.3%.

Financials

Gap ended the quarter with cash and cash equivalents of $1,210 million, long-term debt of $1,249 million and total stockholders’ equity of $3,197 million.

In first-quarter fiscal 2018, the company used cash flow from operations of $66 million and incurred capital expenditures of $138 million. Gap had negative free cash flow of $204 million as of May 5, 2018.

For fiscal 2018, management continues to project capital expenditures of roughly $800 million, which will be used for transformative infrastructure investments to enhance its omni-channel and digital strategies, including information technology as well as supply chain.

Coming to Gap’s shareholder-friendly moves, the company paid dividends of $94 million in the reported quarter and bought back 3.2 million shares for approximately $100 million. It paid dividend of 24.25 cents per share in the quarter, which reflects growth of more than 5% year over year. Additionally, Gap announced a second-quarter dividend of 24.25 cents per share, which is payable on or after Aug 1, to shareholders of record on Jul 11.

Moving ahead, management still plans to buyback worth roughly $100 million every quarter.

Store Updates

While Gap launched 62 stores including 26 company-operated and 36 were franchises, it shuttered 39 outlets in the first quarter. The stores that were closed included 20 company-operated and 19 franchise locations. Consequently, the company ended the quarter with 3,617 outlets in 45 countries, of which 3,171 were company-operated and 446 were franchises.

In fiscal 2018, Gap anticipates opening nearly 25 company-operated stores, net of closures and repositions. In sync with its growth strategy, the company expects to open more of Athleta and Old Navy stores and close down Gap and Banana Republic stores.

Outlook

Following the mixed quarterly results, Gap reaffirmed outlook for fiscal 2018. Comps are still anticipated to be flat to up slightly. Earnings for the year are anticipated in the range of $2.55-$2.70 per share.

Moreover, the effective tax rate for fiscal 2018 is still expected to be nearly 26% due to the impacts of the recent tax reform.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed a downward trend in fresh estimates. There have been four revisions higher for the current quarter compared to five lower.

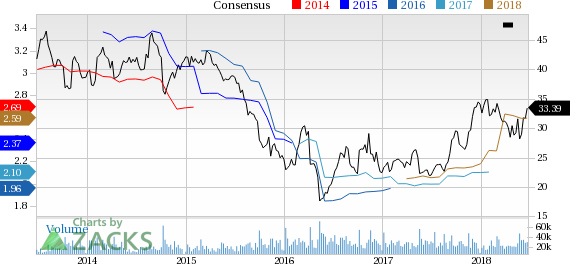

The Gap, Inc. Price and Consensus

The Gap, Inc. Price and Consensus | The Gap, Inc. Quote

VGM Scores

At this time, GPS has a subpar Growth Score of D, though it is lagging a bit on the momentum front with an F. However, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

The company's stock is suitable solely for value based on our styles scores.

Outlook

Estimates have been trending downward for the stock and the magnitude of these revisions indicates a downward shift. It's no surprise GPS has a Zacks Rank #4 (Sell). We expect a below average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Gap, Inc. (GPS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance