Why a government spending package would be a disaster for the US economy right now

The economics community agrees on one thing right now: the US needs to spend more on infrastructure.

But there’s a simple reason why this is not what the economy needs — the timing is all wrong.

“This is exactly the wrong time in the [economic] cycle for fiscal stimulus,” writes Binky Chadha, chief strategist on Deutsche Bank’s Asset Allocation team.

Because while the US economy continues to see top-line GDP growth in the 2% per year range, the labor market has tightened considerably, inflation — while below the Fed’s stated target — is not anemic, and the dual shocks of a crash in oil prices and a strong US dollar are beginning to dissipate. Adding a stimulus package to this mix, then, risks upsetting the equilibrium — however disappointing — the economy has settled into.

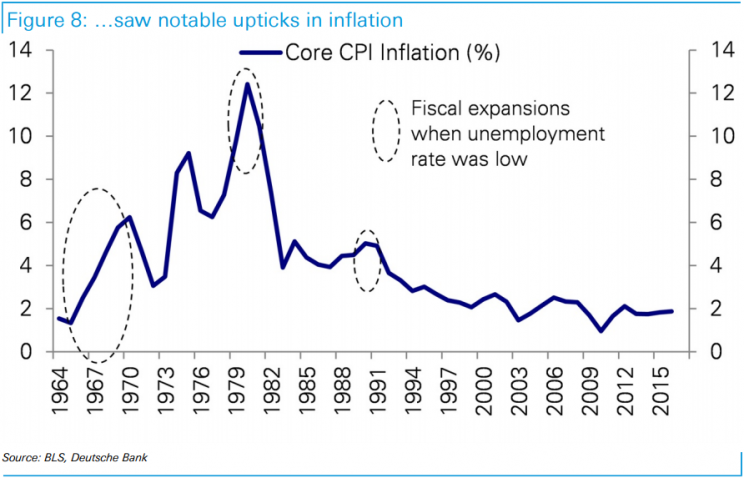

There is also some troubling historical precedent when it comes to the US government adding stimulus to an economy already running hot.

Chadha noted that there have been three instances in the last 60 years in which the government has ramped up spending into a hot labor market. All three instances — 1966-68, 1980-81, and 1991 — saw inflation rise notably.

Were something similar to play out this time around, we’d likely be on the path towards more aggressive rate hikes from the Federal Reserve, potentially stalling out the economy and achieving the exact opposite result desired by a spending package from congress.

More inflation, and faster rate hikes, is also the opposite scenario being priced in by markets right now, which expect to see just one additional rate hike from the Fed through this time next year.

“We see increased government expenditure as having a temporary positive impact on growth followed by a protracted drag,” Chadha writes.

Adding: “But at this stage in the cycle it is likely to lead to a sharp move higher in inflation. In addition, potential fiscal stimulus increases the likelihood of the Fed stepping back from ‘being the only game in town’ and normalizing rates faster. With the market pricing barely 1 rate hike over the next 3 years, we see potential fiscal stimulus as increasing the risk of a disorderly re-pricing of rates.”

Ironically, when it comes to the US economy it seems Donald Trump and Hillary Clinton can only agree on one thing, which is that the US needs to spend more on infrastructure.

But as we highlighted on Monday, some analysts have cast doubt on the idea this type of package could be an easy way to jumpstart a middling US economy.

Chadha’s colleague at Deutsche Bank, John Tierney, recently outlined a number of reasons why calls for big spending packages are misguided. But Chadha’s follow-on note dives home why this bi-partisan call to action is misguided — the timing is just all wrong.

—

Myles Udland is a writer at Yahoo Finance.

Read more from Myles here:

4 newspaper headlines tell the whole story of the US labor market

The one thing Trump and Clinton agree on may be a terrible idea for the US economy

Yahoo Finance

Yahoo Finance