Why extreme weather fuels commodity markets

Most people don’t fear little girls, but meteorologists know better when it comes to this one, and so do economists. In September, the risk of La Niña, (Spanish for “little girl”), a weather pattern that in its strongest manifestation has been blamed for flooded mines in Australia and failed crops in Brazil, was tripled to 60pc by the US Climate Prediction Centre.

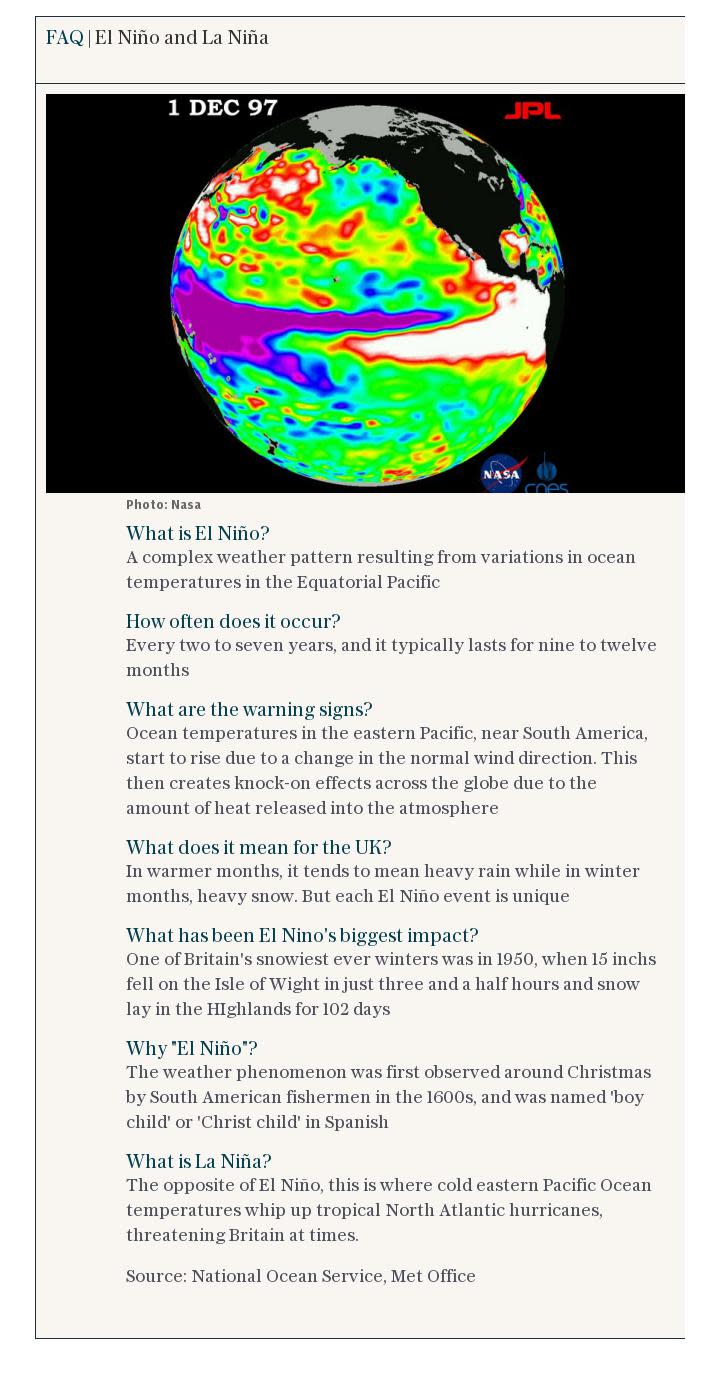

La Niña is part of what is known as the El Niño-Southern Oscillation cycle. While El Niño warms waters in the central Pacific Ocean, La Niña has an opposite effect. And the changes in sea temperature caused by these weather events can trigger large shifts in weather patterns. When a strong La Niña hits, as seen in 2010-11, it can cause drought, flooding and, at its most bizarre, bumper catches off the coast of Peru as fluctuations in water temperatures change the feeding grounds of fish.

Even just a hint of its arrival can raise coal prices, as markets remember when the strong La Niña of 2010-11 flooded coal production areas such as Queensland in Australia.

Professor Adam Scaife, head of long-range prediction at the UK Meteorological Office, says that while the risk of a La Niña as extreme as that seen six years ago is low, it’s important to consider the ramifications even a relatively weak event can have for next year’s hurricane season.

“There are a couple of things that can take the wind out of a hurricane: one is landfall, which denies the storm access to the warm ocean surface and increases surface friction,” Scaife explains. The other, he notes, is when winds run counter to one another near the ocean surface and then at altitude. This difference is known as a shear.

“If that difference is strong enough it can shear out and kill a growing storm. As La Niña weakens the wind shear in the Atlantic, it tends to be associated with an active hurricane season,” he says.

The increased risk of this weather event comes hot on the heels of a devastating hurricane season. AccuWeather has estimated that hurricanes Harvey and Irma might cost a combined $290bn (£222bn), nearly double that of the season that produced Hurricane Katrina.

Harvey, which killed more than 80 people and caused major flooding in Texas this September, is a useful example of just how distorting extreme weather can be to the extraction, and production of, commodities like oil.

“When a disruption like that happens it really shines a light on how complex the process [is] of getting oil to the point where it is diesel or petrol at a service station,” says Callum Macpherson, head of Investec’s commodities team.

The point with Harvey, which traders, businesses and consumers alike ought to consider, he notes, is that not only did the resultant flooding curtail oil extraction in the US, it also disrupted the refining industry: “In the US, road transport tends to be dominated bwy petrol cars. So when they shut down, the price of petrol in the US went crazy.” Unable to refine oil, consumers and companies had to rely on inventories of petrol.

“That tends to push up the price of things that come out of refineries,” adds Macpherson. Increased pressure on this point of the supply chain means there’s minimal capacity left for unrefined oil, so fresh from extraction, it is placed into stores, and its value drops. There’s a knock-on effect beyond too.

“It rippled around the world. Because US consumption is quite petrol-focused, it tends to produce an excess [of] what are called middle distillates such as jet fuel and diesel, and these are shipped over to Europe,” explains Macpherson.

It’s a highly effective trade in by-products from one market for use in another. However, when Harvey hit, and refineries in the US shut down, this flow of distillates stopped. The consequence was a steep rise in jet fuel and diesel prices in Europe. Refiners on the continent attempted to fill the gap and, while this offset the price rises to some extent, it also increased demand for local Brent crude oil.

“The consequence of the hurricane is that it caused significant changes in the price of different oil-based products relative to one another. Refined products increased in price relative to crude oil, and the price of crude oil – in this case Brent – rose relative to that extracted in the US,” says Macpherson.

When trying to assess the likely impact on commodities of weather events, it is crucial to think beyond the immediate impact on crop yield and damage to physical infrastructure. Working backwards from consumer demand may prove a more effective way to gauge the market impact of events such as La Niña.

Warren Patterson, commodity strategist at ING, thinks early signs of La Niña are already manifesting themselves: “We’ve already seen drier weather in Brazil, which is usually the case for La Niña, from now until the end of the year. There is the potential that this could have lower soybean yields, and to a lesser extent corn.”

But while it could pull down production levels in Brazil, it may be good for the harvest of Australian sugar cane, and stimulate a further rebound in South African crops, as wetter weather hits. Sugar cane is a major crop for several southern African nations.

And this bumper harvest could come exactly as UK farmers push ahead with increased production in sugar beet following the lifting of EU production and export caps on sugar. La Niña might spell bad news for sugar prices, even as it supports the price that soybeans can command.

So while cooling waters in the Pacific might seem an abstract or remote concern, observers in the commodities markets will be paying close attention. As should UK sugar beet farmers. Take note: this little girl has clout.

Yahoo Finance

Yahoo Finance