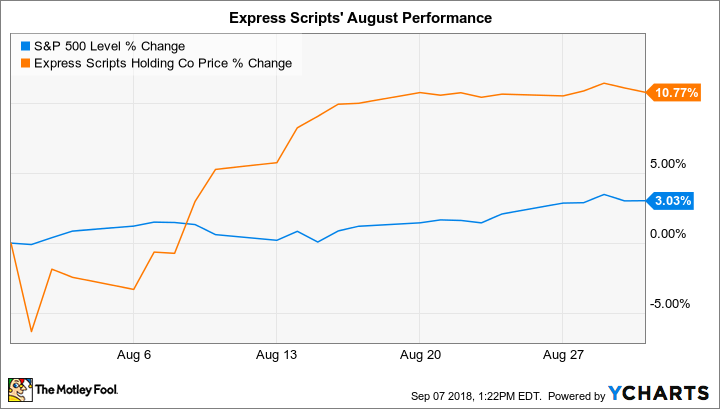

Why Express Scripts Gained 11% in August

What happened

Express Scripts Holding Company (NASDAQ: ESRX) outpaced the market by gaining 11% last month compared to a 3% jump in the S&P 500, according to data provided by S&P Global Market Intelligence.

The increase kept the stock ahead of the broader market so far in 2018, although shares have trailed indexes by a wide margin since early 2016.

So what

The pharmacy-benefit manager announced second-quarter earnings early in the month that included slightly lower sales and higher profits. Adjusted claims fell 3.5% to match management's forecast while adjusted earnings rose thanks to cost cuts and prescription product upsells. "We are having a strong selling season across both commercial and health plans," CEO Tim Wentworth said in a press release.

Image source: Getty Images.

Now what

Wentworth and his team lifted several of their operating forecasts for the fiscal year ahead thanks to rising retention rates and improved demand. Meanwhile, executives still expect to be acquired by Cigna in a deal that's likely to close before the end of 2018. That process took a big step forward when shareholders voted to approve the proposed merger on Aug. 24.

More From The Motley Fool

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance