Why Donald Trump is going to be great for Warren Buffett

The cornerstone of Donald Trump’s economic proposals is cutting taxes — he’s proposed a 15% corporate rate, down from the current 35% — and this could be a boon for Warren Buffett and his company, Berkshire Hathaway (BRK-A, BRK-B).

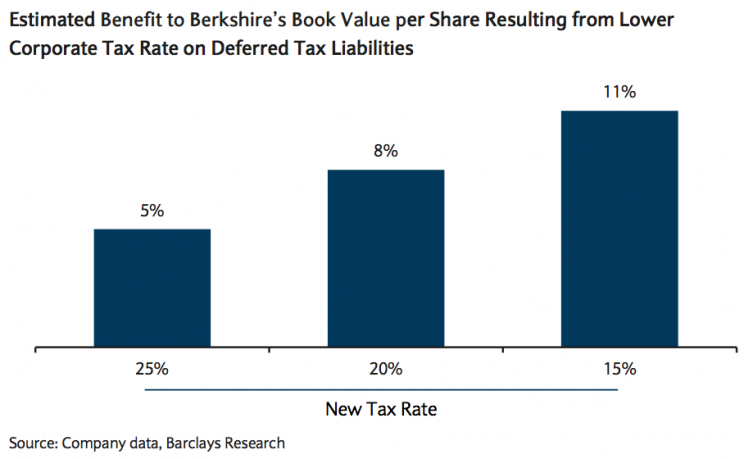

“Berkshire Hathaway’s book value could boosted by $29 billion (11% increase) if the US corporate tax rate is reduced to 15% due to a decline in its deferred tax liability,” writes Barclays analyst Jay Gelb.

“We would view this magnitude of increase as favorable for BRK shares since it is generally valued based on price-to-book value.”

The irony, of course, is that Buffett blasted Trump during the presidential campaign, taking repeated digs at Trump’s refusal to release his tax returns during a Hillary Clinton campaign event in Omaha.

As The Wall Street Journal noted Monday, however, Trump’s election has been good for Buffett, as shares of Berkshire Hathaway surged in November and are now up over 20% this year.

On a corporate balance sheet, the deferred tax liability is basically money set aside to pay taxes at a future date. If the corporate tax rate falls as Trump proposes, then the deferred tax liability on Berkshire’s balance sheet (or any company’s) declines as future taxes would expected to be lower.

And as Gelb noted, this matters more for Berkshire than other companies as the stock is typically valued off of its book value — effectively the liquidation value per share — rather than a more common measures like forward earnings or earnings before interest, tax, depreciation and amortization (EBITDA).

And the reason is simple: because this is how Buffett views the company.

Here’s Buffett on how he views the two core valuations of Berkshire — book and intrinsic value — in the 1983 annual letter to shareholders:

We report our progress in terms of book value because in our case (though not, by any means, in all cases) it is a conservative but reasonably adequate proxy for growth in intrinsic business value — the measurement that really counts. Book value’s virtue as a score-keeping measure is that it is easy to calculate and doesn’t involve the subjective (but important) judgments employed in calculation of intrinsic business value. It is important to understand, however, that the two terms – book value and intrinsic business value – have very different meanings.

Book value is an accounting concept, recording the accumulated financial input from both contributed capital and retained earnings. Intrinsic business value is an economic concept, estimating future cash output discounted to present value. Book value tells you what has been put in; intrinsic business value estimates what can be taken out.

An analogy will suggest the difference. Assume you spend identical amounts putting each of two children through college. The book value (measured by financial input) of each child’s education would be the same. But the present value of the future payoff (the intrinsic business value) might vary enormously — from zero to many times the cost of the education. So, also, do businesses having equal financial input end up with wide variations in value.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance