Why Dollarama's pledge to keep prices under $4 could be holding it back

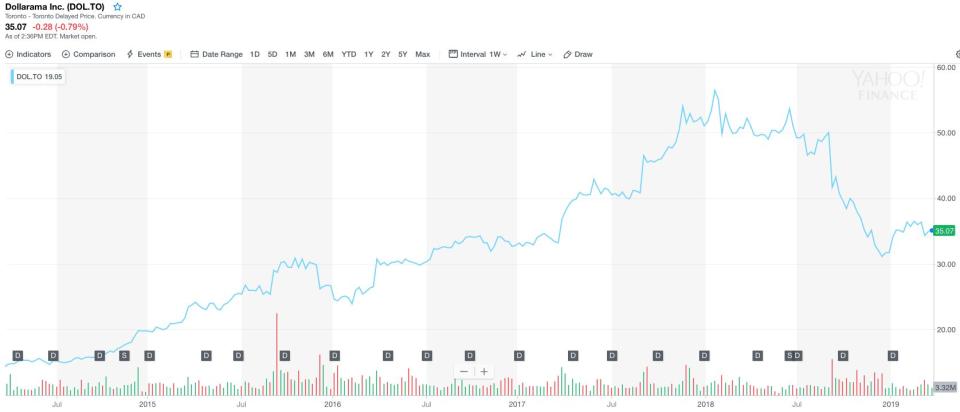

Dollarama (DOL.TO) investors will have to wait to see if the former stock market darling can turn things around because the company’s quarterly profit has once again missed analysts’ expectations.

Fourth-quarter profit of $172 million is up from $162.8 million a year earlier.

Earnings per share of 54 cents narrowly missed a profit of 55 cents per share Bay Street called for.

Fewer customers shopped at Dollarama. Even though the average transaction size rose 3 per cent, but the number of transactions fell 0.4 per cent.

Comparable same store sales rose 2.6 per cent.

Bruce Winder says the results were okay but not great.

“I’m concerned that the number of transactions are down but an increase in basket size helped offset this dynamic,”Winder, co-founder & partner at Retail Advisors Network, told Yahoo Finance Canada.

“No surprises from my perspective —looks like they have arrived on their journey from great to good.”

The Canadian chain now sells items ranging up to $4 but says it won’t go any further in the face of competition from rivals like U.S.-based Dollar Tree (DLTR).

Winder says Dollarama is caught in a dilemma.

“They can't afford to raise prices due to Dollar Tree selling everything at $1.25 but they need gross margin relief.”

“They will need to keep prices low or risk more customers shopping elsewhere and will need to find ways to reduce selling, general and administrative expenses costs to live on tighter gross margins.

Peter Hodson, founder and head of research at 5i Research, says capping prices is the right thing to do.

“It hurts in the short term but maintains Dollarama’s competitive situation,” Hodson told Yahoo Finance Canada.

Hodson says things could have been worse.

“The numbers are likely not as bad as some were worried about, but we still have a slowing-growth situation here.”

Hodson says the margins are being guided lower and Dollarama seems to be taking a conservative approach.

Dollarama also raised its quarterly dividend from 4.4 cents per share from four cents. Hodson says investors won’t care much because the dividend is so low anyway.

Dollarama shares were down around 2.61 per cent after the opening bell but rebounded later in the day.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance