Why Is Century Aluminum (CENX) Down 9.6% Since the Last Earnings Report?

More than a month has gone by since the last earnings report for Century Aluminum Company CENX. Shares have lost about 9.6% in that time frame, underperforming the market.

Will the recent negative trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important catalysts.

Century Aluminum Q3 Earnings Miss, Sales Beat Estimates

Century Aluminium reported net income of $20.8 million or 22 cents per share in third-quarter 2017, against a net loss of $58.3 million or 67 cents it posted a year ago.

The results in the reported quarter were aided by a $5.5 million gain on the settlement associated with retirement benefits for former employees of the Ravenswood facility and a $0.9 million gain related to LME forward sales.

Barring one-time items, Century Aluminum’s adjusted earnings were 15 cents per share in the quarter, which missed the Zacks Consensus Estimate of 23 cents.

Revenues and Shipments

The company registered revenues of $400.6 million in the reported quarter, up around 19.9% year over year. The figure surpassed the Zacks Consensus Estimate of $392 million. Shipments of primary aluminum in the quarter were 184,974 tons, up from 182,429 tons shipped a year ago.

Financials

Century Aluminum cash position increased 48.1% year over year to $174.2 million owing to strong conversion of earnings to cash flow. Net cash provided by operating activities in the quarter was $47.4 million.

Outlook

According to the company, market fundamentals and demand across key markets in the United States and Europe remain favorable.

Commodity prices have increased of late, including alumina, aluminum, pitch and petroleum coke. Century Aluminum expects to witness the impact of each of these prices in fourth-quarter 2017. Changing regulatory environment in China remains the main driving force behind these dynamics.

Over the mid-to-longer term, the direction of the metal prices is expected to depend upon China’s commitment to eliminate illegally subsidized overproduction and implement long-term discipline.

How Have Estimates Been Moving Since Then?

Following the release, investors have witnessed a downward trend in fresh estimates. There have been two revisions lower for the current quarter. In the past month, the consensus estimate has shifted downward by 28.3% due to these changes.

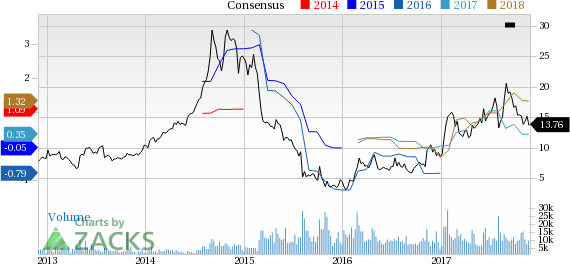

Century Aluminum Company Price and Consensus

Century Aluminum Company Price and Consensus | Century Aluminum Company Quote

VGM Scores

At this time, Century Aluminum's stock has a strong Growth Score of A, though it is lagging a bit on the momentum front with a B. However, the stock was allocated a grade of D on the value side, putting it in the bottom 40% for this investment strategy.

Overall, the stock has an aggregate VGM Score of B. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than momentum investors.

Outlook

The stock has a Zacks Rank #5 (Strong Sell). We are expecting an below average return from the stock in the next few months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Century Aluminum Company (CENX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance