Why Cascades Stock Jumped 16.6% Last Month

Written by Kay Ng at The Motley Fool Canada

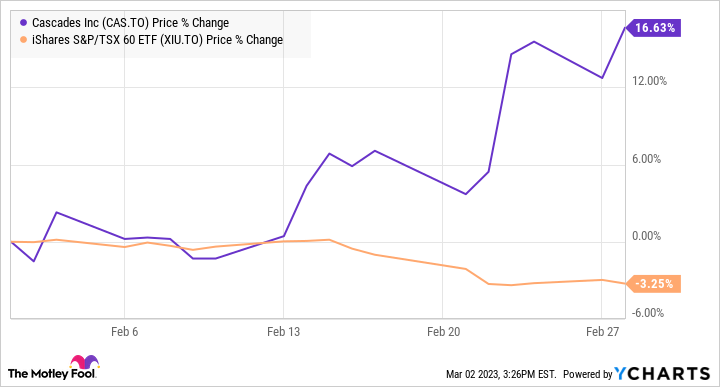

Cascades (TSX:CAS) stock was an outperformer last month! It jumped more than 16% in the period versus the Canadian stock market (using iShares S&P/TSX 60 Index ETF as a proxy) that declined 3%.

CAS data by YCharts

A big chunk of the jump (10% upside) occurred after the company reported its fourth-quarter (Q4) and full-year 2022 results. Let’s take a quick look.

Cascades’s recent results

In Q4, Cascades increased its sales by 10% to $1,135 million. Although the company reported an operating loss of $20 million, it was a big improvement from Q4 2021’s operating loss of $90 million. Additionally, its adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), a cash flow proxy, was $116 million, up from $62 million a year ago. And its adjusted earnings per share (EPS) was $0.22 versus an adjusted net loss per share of $0.09 in Q4 2021.

The full-year 2022 results were stable. Sales climbed 13% to $4,466 million. Operating income was $33 million versus $50 million in Q4 2021. And its adjusted EBITDA was $376 million versus $389 million a year ago. Ultimately, the adjusted EPS was $0.37, up from $0.26 in 2021.

From the previous quarter, Cascades reduced its net debt by 2% to $1,966 million. Consequently, its net debt-to-adjusted EBITDA ratio declined to 5.2 times from 6.2 times.

What might have driven the rally

In all honesty, I feel that Cascade’s 2022 results did not really stand out. Besides, examining the business’s performance through economic cycles, its results have been highly cyclical, no matter if you look at it from a cash flow or adjusted earnings perspective.

So, perhaps what really drove the rally was the update of Cascades’s strategic plan to create value and improve profitability. Specifically, the news pointed out that the update introduced new financial targets that focused on free cash flow generation and a plan to improve profitability of its Tissue Group.

This update has investors’ hopes high that the company’s profitability can improve meaningfully from both a cash flow and earnings perspective.

Cascades’s dividend

Interestingly, despite its unpredictable profitability, Cascades has paid common stock dividends for many years. It even began raising its dividend at a double-digit clip since 2019. Since 2018, its dividend has tripled!

At $10.79 per share at writing, the dividend stock yields 4.4%. Although Cascades used more than all of its cash flow for capital investments last year, investors would be delighted to know that it has about $1.2 billion in retained earnings, which can serve as a strong buffer, covering 25 years of dividend payments based on its latest dividend.

The Foolish investor takeaway

As a leader in sustainable recycling, hygiene, and packaging solutions, Cascade produces and markets packaging products and tissue papers made primarily from recycled fibres. Since raw material prices can be quite volatile depending on supply and demand dynamics, its input costs can change quite drastically. This results in Cascade’s profitability being cyclical as well.

After the rally in the stock, there’s not much near-term upside left. Analysts have a 12-month consensus price target of $11.17 per share, which represents only 3.5% near-term upside potential. Investors are better off waiting for a better entry point. In the meantime, consider the best Canadian stocks to buy.

The post Why Cascades Stock Jumped 16.6% Last Month appeared first on The Motley Fool Canada.

Just Released! 5 Stocks Under $50 (FREE REPORT)

Motley Fool Canada's market-beating team has just released a brand-new FREE report revealing 5 "dirt cheap" stocks that you can buy today for under $50 a share.

Our team thinks these 5 stocks are critically undervalued, but more importantly, could potentially make Canadian investors who act quickly a fortune.

Don't miss out! Simply click the link below to grab your free copy and discover all 5 of these stocks now.

Claim your FREE 5-stock report now!

More reading

Brookfield Asset Management Spin-Off: What Investors Need to Know

Passive Income: 4 Safe Dividend Stocks to Own for the Next 10 Years

Fool contributor Kay Ng has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2023

Yahoo Finance

Yahoo Finance