Why CalAmp Stock Dropped Today

What happened

Shares of CalAmp (NASDAQ: CAMP) were down 10.2% as of 3 p.m. EDT on Wednesday after Goldman Sachs downgraded shares of the machine-to-machine communications leader.

More specifically, Goldman analyst Jerry Revich downgraded CalAmp from neutral to sell and lowered the firm's per-share price target on CalAmp stock by $2, to $11 -- almost where it's trading after today's decline.

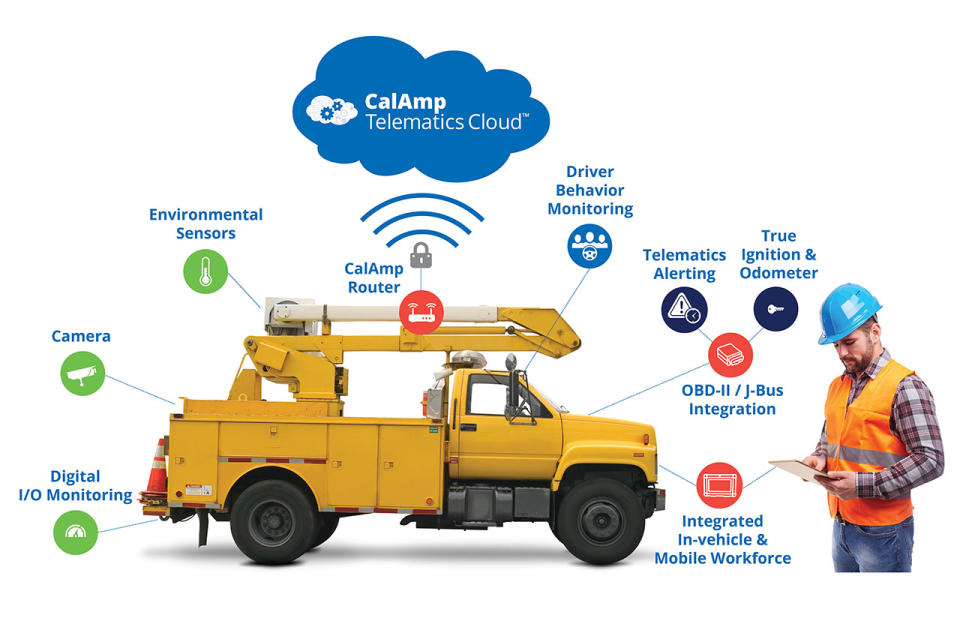

IMAGE SOURCE: CALAMP.

So what

Revich did acknowledge the relative strength of CalAmp's recurring subscription business, growth from which should accelerate in the coming quarters thanks to a number of strategic acquisitions in recent months. But to justify his bearishness -- and keeping in mind one of CalAmp's largest customers is Caterpillar -- Revich worries that CalAmp's recent telematics headwinds will only grow more severe given a cyclical slowdown in the truck and construction markets. That could make finding organic growth, which is elusive enough as it is, even more difficult going forward.

Now what

CalAmp has yet to schedule its fiscal first-quarter 2020 earnings release. But if its past timing is any indication, we should receive more color on the state of its truck and construction markets with another quarterly release in late June. Given this note of caution, however, and even with shares down 45% in the 12 months prior to this downgrade, it's hardly surprising that traders are bidding down CalAmp stock today.

More From The Motley Fool

Steve Symington has no position in any of the stocks mentioned. The Motley Fool recommends CalAmp. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance