Why You Should Buy The Cooper Companies (COO) Stock Now

The Cooper Companies, Inc. COO is well poised for growth, backed by strong prospects in both CooperVision (CVI) and CooperSurgical (CSI) business segments. Acquisitions boost the company’s portfolio and buoy optimism. However, unfavorable currency movements and rising costs continue to hurt revenues and margins, respectively.

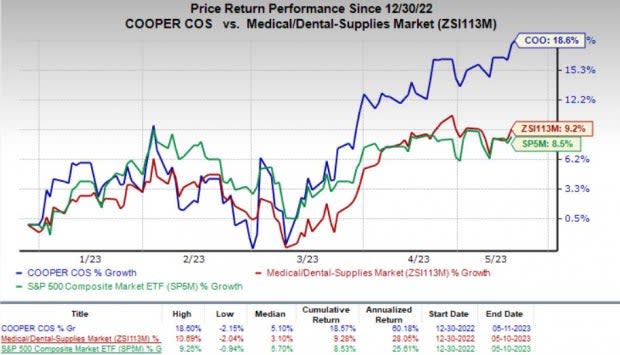

Shares of this Zacks Rank #2 (Buy) company have gained 18.6% compared with the industry's 9.2% growth so far this year. The S&P 500 Index has gained 8.5% in the same time frame.

The Cooper Companies, with a market capitalization of $19.33 billion, is a specialty medical device company operating on a global basis. The company’s bottom line is estimated to improve 11% over the next five years. COO’s earnings missed estimates in three of the trailing four quarters and beat once, the average negative surprise being 1.82%.

Image Source: Zacks Investment Research

What's Driving The Cooper Companies’ Performance?

The company has been leading the specialty lenses market, owing to highly exclusive products of Biofinity and Clariti, and growing products of MyDay and MiSight. Its flagship silicone hydrogel lenses are expected to derive strong sales in the upcoming quarters.

In the fiscal first quarter of 2023, COO witnessed substantial growth across CVI’s Toric, Multifocal and single-use sphere subunits. It also witnessed an organic improvement in sales on a geographical basis, with EMEA, the Americas and the Asia-Pacific markets exhibiting strength in the aforementioned quarter.

The CVI segment continued to display solid performance in the same time frame, with its revenues rising 10% at a constant exchange rate and on an organic basis to $581.3 million. Per management, strong demand for silicone hydrogel lenses contributed to the segmental uptick. CVI revenues are likely to be in the $2.352-$2.388 billion (organic growth of 8-9%) range in fiscal 2023.

The Cooper Companies is well positioned to benefit from the expanding CSI product portfolio as well. In first-quarter fiscal 2023, CooperSurgical witnessed revenue growth in two focus areas, fertility, and office and surgical products. Revenues from fertility increased 16% year over year to $112 million, indicating sustained solid performance. Sales of office and surgical products surged 28% to $165.2 million.

For fiscal 2023, CSI revenues are expected to be in the $1.144-$1.166 billion range, implying an organic increase of 5-7%.

Acquisitions to Drive Growth

In 2021, The Cooper Companies acquired privately held Generate Life Sciences, a leading provider of donor eggs and sperms for fertility treatments, fertility cryopreservation services and newborn stem cell storage (cord blood & cord tissue). The deal is expected to have added approximately 30 cents to COO’s adjusted earnings per share (EPS) in the calendar year 2022.

Another acquisition is currently under review. In April 2022, the company entered into an asset purchase agreement to acquire Cook Medical’s Reproductive Health business. The acquisition will add minimally invasive medical devices, focused on the fertility, obstetrics and gynecology markets. The deal is likely to be completed by the end of this year.

The completion of the abovementioned acquisition is likely to add approximately 60 cents to COO’s adjusted EPS in the first year.

Both deals helped The Cooper Companies to diversify its businesses to include fertility-related medical devices.

In 2022, the company formed a joint venture — SightGlass Vision — with another global vision care leader, EssilorLuxottica. It did so to accelerate the commercialization of novel spectacle lens technologies and expand the myopia management category.

What's Weighing on the Stock?

The Cooper Companies generates a significant portion of its revenues in foreign currencies. Fluctuations in foreign exchange rates may significantly mar its overseas revenues. Moreover, an increase in selling, general and administrative expenses is concerning. Contraction in both gross and operating margins is disappointing.

Estimates Trend

The Zacks Consensus Estimate for the company's fiscal 2023 revenues is pegged at $3.53 billion, implying growth of 6.6% from the year-ago reported figure. The adjusted EPS for the same period stands at $12.73, indicating an improvement of 2.5% from the previous year. In the past 30 days, COO witnessed an upward revision of 2.1% in earnings estimates.

The Cooper Companies, Inc. Price and Consensus

The Cooper Companies, Inc. price-consensus-chart | The Cooper Companies, Inc. Quote

Other Key Picks

Some other top-ranked stocks in the broader medical space are AmerisourceBergen ABC, Cardinal Health CAH and CONMED CNMD, all carrying a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AmerisourceBergenhas an estimated long-term growth of 8.9%. The company’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 3.14%.

So far this year, ABC’s shares have gained 3.4% compared with the industry’s 9.2% growth.

Cardinal Health has an estimated long-term growth of 12.4%. Its earnings surpassed estimates in three of the trailing four quarters and missed once, the average beat being 12.28%.

So far this year, CAH’s shares have gained 10.3% compared with the industry’s 9.2% growth.

CONMED has an estimated long-term growth of 19.4%. CNMD’s earnings surpassed estimates in two of the trailing four quarters, missed once and met once, the average miss being 10.54%.

CONMED has gained 37.8% compared with the industry’s 9.2% increase so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CONMED Corporation (CNMD) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

AmerisourceBergen Corporation (ABC) : Free Stock Analysis Report

The Cooper Companies, Inc. (COO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance