Why bitcoin will surge to $25,000

Bitcoin is on a trajectory that will eventually catapult it into bubble territory, with an end target of $25,000 or more.

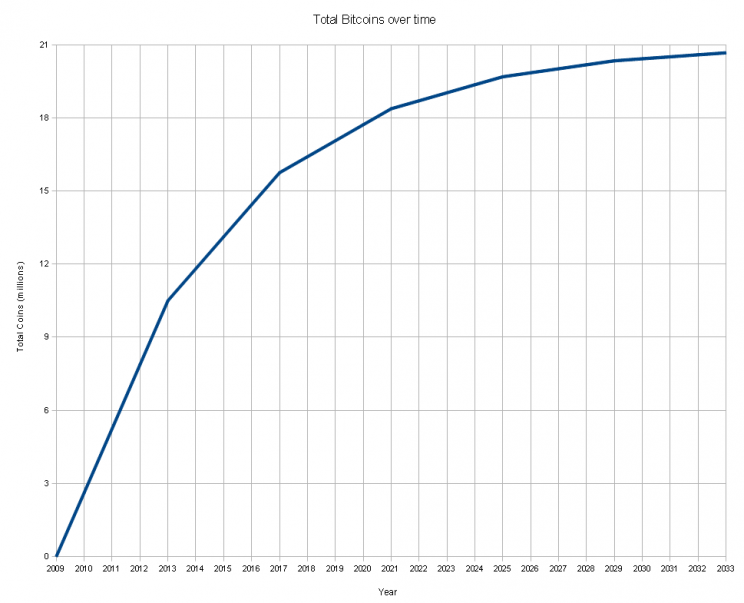

Many of the key ingredients present in past bubbles are now present to create the next one in bitcoin. What makes this possible is the mathematics of finite supply, which we will show you in a chart and is at the core of our argument.

One of the reasons people buy gold is to avoid the dilution of fiat money. In other words, gold investors care about keeping their purchasing power. The alternative is an unlimited supply of paper money over time.

This is why we are convinced that digital money or cryptocurrencies will eventually find its appeal with hard asset investors — or a rare chance to get in on a venture capital style bet.

We fought tooth and nails to get the media to cover gold when it traded at $300. These events work out over cycles measured in decades, which is the amount of time required to convince the majority.

Whether tulips, housing or tech stocks, bubbles require public participation. And as blockchain becomes more ubiquitous, it lends credibility to the technology behind bitcoin. We feel that digital currencies, such as bitcoin, have now entered a similar cycle.

It will take many years of great returns to remove the current skepticism on digital money. And there will be pressure from governments to regulate it, which in the end, will only lend it more legitimacy.

People trade today as they did last year, as they did 100 years ago. The psychology remains the same. Behaviour does not change. Provide the same set of incentives throughout time and the Pavlovian bell rings the same.

When I saw this chart, immediately I saw dollar signs.

Over the lifetime of mining bitcoins, the final amount is set to be 21 million coins. Nothing more and nothing less.

For the time being, it is way too early to ascribe a final end of the road valuation target to bitcoin, even if we hint at a level.

Prior articles:

Why the crisis of 2019 begins now

How to prepare for the next major selloff in stocks: trader

By Yves Lamoureux, January 16, 2017 ©Copyright, Lamoureux & Co.

This communication is for information purposes only and should not be regarded as an offer to sell or as a solicitation of an offer to buy any financial product or service.This publication is proprietary and is intended for the use of the subscriber only. All information provided is impersonal and not tailored to the needs of any person, entity or group or persons. Lamoureux & Co. shall not be liable for any claims.

Yahoo Finance

Yahoo Finance