Income inequality and race affect homeownership rates

The legacy of wealth disparity across racial lines appears to be perpetuated when it comes to the American dream of owning a home.

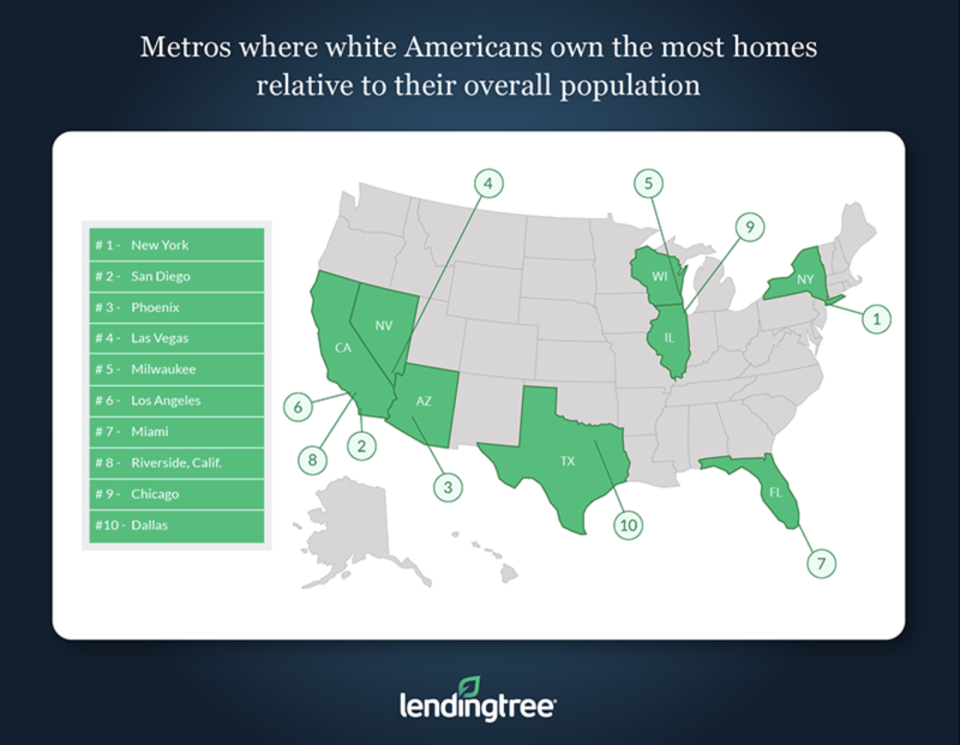

Online loan marketplace LendingTree (TREE) released a study which shows “white Americans tend to own a disproportionately high number of homes relative to the overall population” in several of the country’s largest metro areas.

“White homeownership is much higher than the national average,” according to LendingTree Chief Economist and author of the study Tendayi Kapfidze. The national homeownership rate is around 64% while the ownership rate for white Americans is around 74%.

LendingTree released a similar study last May that showed the black homeownership rate was 41%, the lowest for all racial groups in the United States. Both studies are based on U.S. Census Bureau data.

White homeowner rates are higher than their relative overall population in metro areas like New York, San Diego, and Phoenix.

In the New York City metro area the white population is roughly 47% but the white homeownership rate is 69%. In San Diego the white population is 46% but the ownership rate is 65%. And in Phoenix the white population is 56% while the homeownership rate is 75%

Reasons for inequality

The study offers a few reasons why white Americans own a disproportionate share of homes compared to Americans of other races.

It says, “The advantages afforded to white Americans on the whole are the result of numerous social factors that have historically made it more accessible for white Americans to gain meaningful employment, higher levels of wealth and access to credit.”

The study found white Americans have higher average incomes and are more likely to have a college degree than Americans of other races.

“One of the ways you buy a home is you get some help from mom and dad,” according to Kapfidze. “And if mom and dad already own a home they are much more likely to be able to help their kids afford a home as well.”

Not everything is black and white

Kapfidze says the study’s results do not mean all white Americans will necessarily have an easy time affording a home. “More expensive cities such as New York will tend to have a lower homeownership rate across all races versus less expensive cities,” he said

Kapfidze points out the discrepancies in homeownership also line up with differences in the economy. “Typically a white family will have a higher income and higher net worth and part of that net worth is the homeownership so they tend to own more valuable homes.”

A LendingTree study to be released later this year will attempt to address the discrepancy in homeownership rates by looking at reasons people are denied mortgages. Kapfidze says the number one reason is the debt-to-income ratio that lenders use to approve a loan.

He says, “If you can move that income part of the equation, then you certainly increase access for more people.”

Adam Shapiro is co-anchor of Yahoo Finance On the Move.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance