Why Arconic, Canopy Growth, and Banco Bradesco Jumped Today

Monday was a U.S. federal holiday, but the stock market was still open even though it was apparent that at least some traders took the day off. Major benchmarks were generally little changed, although the Nasdaq Composite suffered a fairly significant loss of more than half a percent. Investors are still trying to incorporate the recent rise in interest rates into their overall strategic picture, and the 10-year Treasury's yield stayed stubbornly near 3.25%, a seven-year high. Even in a mixed market, some stocks pushed their way higher. Arconic (NYSE: ARNC), Canopy Growth (NYSE: CGC), and Banco Bradesco (NYSE: BBD) were among the best performers on the day. Here's why they did so well.

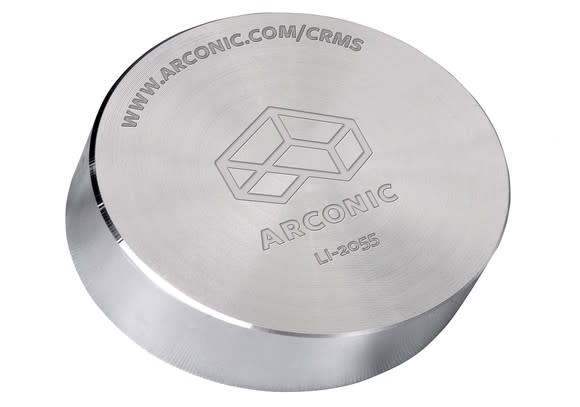

Could Arconic get bought out?

Shares of Arconic rose 7% on speculation that the aluminum products manufacturer could receive an acquisition bid. Reports yesterday suggested that a large group of private equity investors might join forces in order to make an offer to buy out Arconic, which has struggled to find success since its 2016 spinoff from Alcoa. Specializing in high-grade finished aluminum products for advanced applications, Arconic has substantial exposure to the industrial sector, and some fear that a cyclical peak could throw that business into turmoil in the future. For now, though, investors will have to wait to see whether a rare coming-together of competing private equity companies will result in an actual bid.

Image source: Arconic.

Canopy gets ready

Canopy Growth climbed 6% on another solid day for the marijuana stock. Investors are looking carefully at the Canadian market for recreational marijuana in light of the pending legalization of Canadian cannabis later this month, and one study suggests that the supply of marijuana that Canopy and its peers will make available to the market could meet just 30% to 60% of the demand there. That should leave room for Canopy to boost production without fear of causing market disruptions, and that in turn could prove out Canopy's broader goal of becoming a leading supplier of cannabis products both in Canada and worldwide.

Banco Bradesco likes the election results

Finally, shares of Banco Bradesco gained 9%. The big South American bank climbed along with most of the Brazilian stock market in the wake of results of the first round of the nation's presidential elections. As expected, far-right candidate Jair Bolsonaro got far more votes than any other candidate (46%), but he failed to get the outright majority necessary to avoid a second round of voting. Bolsonaro's opponent will be Fernando Haddad, and the runoff will happen in three weeks. For Brazilian stocks, the results could point to a new vision of economic prosperity, especially given the success of Bolsonaro's party in winning seats in Brazil's legislating body. Banco Bradesco's shares reflect that enthusiasm, and it'll be interesting to see how the results play out both later this month and in the coming years.

More From The Motley Fool

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance