Whiting (WLL) Loss Narrower Than Expected in Q4, Sales Top

Whiting Petroleum Corporation WLL reported fourth-quarter 2019 adjusted net loss per share of 22 cents, narrower than the Zacks Consensus Estimate of a loss of 44 cents owing to better-than-expected oil production. Precisely, the company’s realized oil price was $48.67 a barrel, beating the Zacks Consensus Estimate of $47.44.

However, the bottom line per share was wider than the year-ago loss of 5 cents. Lower-than-expected commodity prices caused this underperformance.

Total operating revenues came in at $380.6 million, beating the Zacks Consensus Estimate of $376 million. However, the top line fell 19.6% from the year-ago level of $473.2 million. The company also suffered a spike in operating expenses, which escalated 87% from the prior-year level to $412.4 million.

On an encouraging note, the company’s discretionary cash flow of $188.7 million was higher than the capital spending of $103 million, translating to a positive free cash flow of $86 million.

Production & Prices

Whiting Petroleum’s total oil and gas production reported a nominal year-over-year decrease of 5.4% to 11.32 million oil-equivalent barrels (comprising 82% liquids) and also fell short of the Zacks Consensus Estimate of 11.34 million oil-equivalent barrels. In particular, oil volumes at 7.38 million barrels were down 9.6% from the level achieved in fourth-quarter 2018.

The average realized crude oil price during the fourth quarter was $48.67 per barrel, reflecting a marginal decline from the year-ago realization of $49.26. Moreover, the average realized natural gas liquids price was $8.79 per barrel, plummeting 60.4% from the year-ago period. Natural gas prices also tumbled 84.4% year over year to 41 cents per thousand cubic feet.

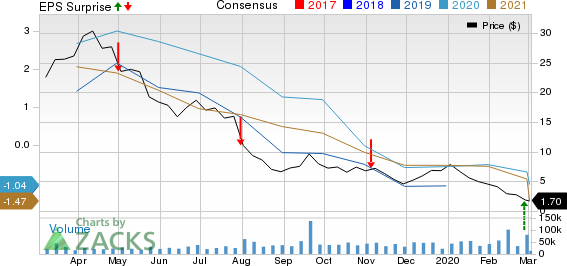

Whiting Petroleum Corporation Price, Consensus and EPS Surprise

Whiting Petroleum Corporation price-consensus-eps-surprise-chart | Whiting Petroleum Corporation Quote

Balance Sheet & Capital Expenditure

As of Dec 31, Whiting Petroleum had approximately $8.7 million in cash and cash equivalents. The oil explorer’s long-term debt of $2,799.8 million represented a debt-to-capitalization ratio of 26.8%. In the reported quarter, the company spent $103 million on its capital program.

Output Guidance

Whiting Petroleum announced its 2020 production outlook and projects it within 40.9-43.3 million barrels of oil equivalent, indicating a fall from the previous year’s reported production volume of 45.8 million barrels of oil equivalent. Following its weak production view, this Denver, CO-based company’s shares shed around 29% of value.

The firm expects 2020 capex in the band of $585-$620 million, suggesting a decrease from $778 million reported in the year-ago quarter. The firm plans to allocate 90% of its total capex to drilling and completion activity depending on the mid-point of its guided range.

Whiting Petroleum aims to operate three rigs and two-three completion crews all the year round and expects 122 gross wells to enter service in 2020.

Zacks Rank & Key Picks

Whiting Petroleum has a Zacks Rank #3 (Hold). Some better-ranked players in the energy space are Contango Oil & Gas Company MCF, Apache Corporation APA and Earthstone Energy, Inc. ESTE, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apache Corporation (APA) : Free Stock Analysis Report

Contango Oil & Gas Company (MCF) : Free Stock Analysis Report

Whiting Petroleum Corporation (WLL) : Free Stock Analysis Report

Earthstone Energy, Inc. (ESTE) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance