Whiting (WLL) Drops to New 52-Week Low on Q3 Earnings Miss

Whiting Petroleum Corporation's WLL share price hit a new 52-week low of $5.23 during the trading session on Nov 19. As a matter of fact, the stock has dived 28.5% since its third-quarter earnings announcement on Nov 5.

This Bakken-focused upstream operator’s weak third-quarter performance and investor pessimism induced by lower average realized commodity prices caused the slump.

The company incurred third-quarter 2019 adjusted net loss per share of 38 cents, wider than the Zacks Consensus Estimate of a loss of 8 cents. Moreover, the loss came in against the year-ago earnings of 92 cents. Lower-than-expected oil, natural gas liquids (NGLs) and gas prices resulted in this underperformance.

The company’s realized NGLs price was $3.07 a barrel, significantly lagging the Zacks Consensus Estimate of $9.21. Realized prices of oil and gas also missed the consensus estimate by 7.9% and 95.8%, respectively.

Additionally, total operating revenues of $375.8 million fell short of the Zacks Consensus Estimate of $411 million. The top line also declined 33.7% from the year-ago level of $566.7 million.

On a further discouraging note, the company’s discretionary cash flow of $178.5 million was lower than the capital spending of $225 million, translating to a negative free cash flow of $46.5 million.

Despite this dull scenario, the company’s third-quarter results offered some relief to buoy long-term investors’ optimism as total operating expenses decreased 11.6% from the prior-year level to $351.2 million.

Production & Prices

Whiting Petroleum’s total oil and gas production recorded a nominal year-over-year decrease of 4.03% to 11.36 million oil-equivalent barrels (comprising 81.6% liquids) and further fell shy of the Zacks Consensus Estimate of 11.42 million oil-equivalent barrels. In particular, oil volumes at 7.44 million barrels were down 5.9% from the level achieved in third-quarter 2018 as adverse weather induced operating delays and hampered production.

The average realized crude oil price during the third quarter was $51.12 per barrel, reflecting a decrease of 10.03% from the year-ago realization of $56.82. Moreover, the average realized natural gas liquids price was $3.07 per barrel, plummeting 86.18% from the year-ago period. Natural gas prices also tumbled 97.05% year over year to 3 cents per thousand cubic feet.

Balance Sheet & Capital Expenditure

As of Sep 30, the oil explorer had long-term debt of $2,605.02 million, representing a debt-to-capitalization ratio of 25.09%. In the reported quarter, the company spent $225 million on its capital program.

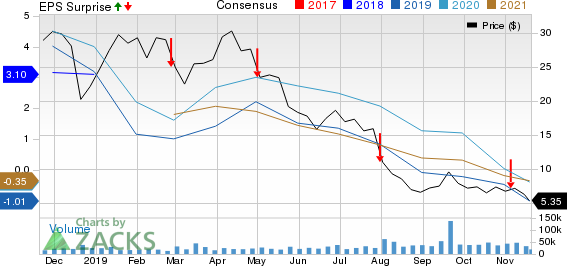

Whiting Petroleum Corporation Price, Consensus and EPS Surprise

Whiting Petroleum Corporation price-consensus-eps-surprise-chart | Whiting Petroleum Corporation Quote

Capex Guidance

Whiting Petroleum forecasts a decline in capital spending for the fourth quarter to $134-$154 million as a significant portion of the capital investment required for wells during the fourth quarter was incurred in the third quarter and as activity declines seasonally.

Whiting Petroleum maintained its 2019 production guidance on account of issues related to infrastructure constraints, which are expected to persist in the remaining year. The company expects full-year production in the range of 45-46.5 million barrels of oil equivalent. However, it tightened its 2019 capex outlook to the $810-$830 million band.

Zacks Rank & Key Picks

Whiting Petroleum currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the energy space include Phillips 66 PSX, Delek Logistics Partners, L.P. DKL and PBF Logistics LP PBFX, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Delek Logistics Partners, L.P. (DKL) : Free Stock Analysis Report

PBF Logistics LP (PBFX) : Free Stock Analysis Report

Phillips 66 (PSX) : Free Stock Analysis Report

Whiting Petroleum Corporation (WLL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance