Where Will Shopify Inc. Be in 5 Years?

Don't look now, but Shopify (NYSE: SHOP) is staging a spunky little comeback. Shares of the e-commerce platform provider have moved higher for four consecutive trading days, soaring 17% in the process. Outside of a well-received third quarter late last month, this week's rally is the first sign in weeks that Shopify is clawing its way back into favor.

Baird analyst Colin Sebastian put out a bullish note on the stock earlier this week. His tracking of the platform suggests that the current quarter is running ahead of Wall Street expectations. He feels that Shopify's collection of stores experienced a 50% to 60% surge in sales volume through the first few days of the holiday shopping season. Shopify has done well in the past, and it's apparently nailing the present. Let's take a peek at its potential future.

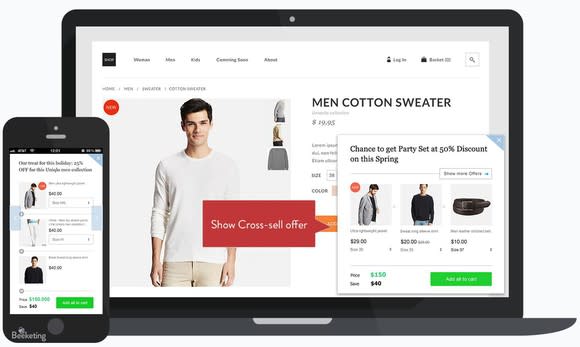

Image source: Shopify.

Party like it's 2023

Wall Street sees the heady growth continuing in the coming years. Looking out five years, analysts forecast Shopify earning nearly $7 a share, well above today's meager profitability. They also predict revenue of $4.1 billion in 2023, roughly quadrupling from the $1.045 billion to $1.055 billion that Shopify is targeting for this year's top-line results.

A lot can happen between now and then, and it probably will when it comes to Shopify. The platform's appeal these days is clear. Aspiring and established merchants pay as little as $9 a month to be on the platform that seamlessly populates products across various e-commerce and social platforms. Basic plans start at $29 a month, going all the way up to $299 a month.

There are now more than 600,000 digital storefronts on Shopify, so it's obviously doing something right. Quadrupling its revenue from current levels will require a combination of account growth as well as the average revenue per user moving higher. Increasing its merchant count will require Shopify to broaden its already-impressive international reach. It will also need to continue manning affiliate marketing and referral programs to encourage users to promote the platform.

Increasing its average revenue per business will call for Shopify to continue appealing to larger merchants, but the easier path there will be to just keep introducing new services and platform enhancements. It's an easy sell for Shopify, as it already has more than 600,000 merchants leaning on it to generate sales. They're in this together, as merchant success reflects on Shopify's results. Merchant solutions revenue is growing faster than its steadier subscription revenue, and that will likely continue to be the case.

Shopify stock isn't cheap now, and if it lives up to or exceeds analyst expectations, it's not likely to command anything close to market multiples in the future. However, if the stock were to, say, double in five years, we'd be looking at a stock fetching 43 times that year's profit target and less than eight times revenue. The upside is there for the taking, and it bears pointing out that Shopify has blown through Wall Street estimates in the past without trouble. The easy money may have already been made, but now it's time for Shopify to make the smart money.

More From The Motley Fool

Rick Munarriz has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Shopify. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance