Where to Invest $1,000 for the Next 5 Years

Written by Kay Ng at The Motley Fool Canada

If you have extra cash you don’t need for the next five years, you should consider investing in solid growth stocks to strive for higher growth. The Canadian stock market, using iShares S&P/TSX 60 Index ETF as a proxy, is still down about 11% from its peak this year. A bunch of growth stocks sold off along with the market selloff.

For example, Brookfield Asset Management (TSX:BAM.A)(NYSE:BAM) is still about 20% below its peak this year. Although the stock corrected more substantially than the market, it also has the potential to outperform the market. Indeed, it has done so in the long run.

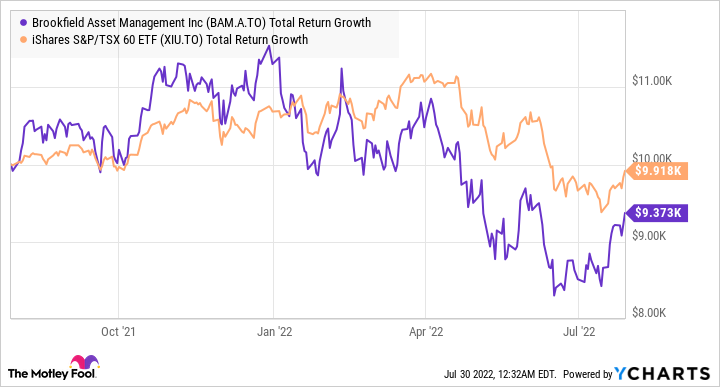

Here’s a one-year total return chart comparing BAM and XIU assuming an initial investment of $10,000.

BAM.A and XIU Total Return Level data by YCharts

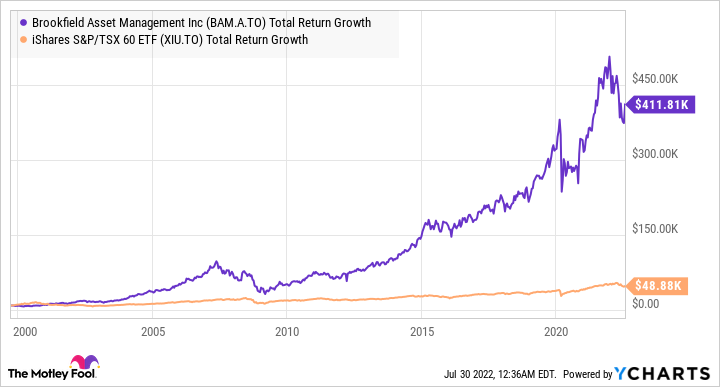

The following is a 10-year chart illustrating longer-term results.

BAM.A and XIU Total Return Level data by YCharts

The chart below shows the longest history available via YCharts. The long-term results of an investment in Brookfield Asset Management stock are astounding, going as far as 41 times investors’ money in about 22 years. This equates to an annualized total return of roughly 18%, turning $10,000 into $411,810, which could contribute nicely to anyone’s retirement fund.

BAM.A Total Return Level data by YCharts

In the last 20 years, it would be smart for long-term investors to buy the growth stock on market corrections. In fact, an investor could argue that it would have been smart to buy any time that one had extra cash.

The business

The global alternative asset manager has about US$725 billion of assets under management (AUM), including real estate, infrastructure, renewable power, private equity, and credit. It earns management fees on about half of its AUM. It also earns performance fees when it hits certain return targets for its clients. Furthermore, BAM generates strong cash flows on a bunch of its operating businesses, including in the areas of real estate, infrastructure, and renewable power.

Strong growth potential

According to the Willis Towers Watson Global Pension Assets Study in 2020, alternatives made up only 5% of investment portfolios in 2000. That asset allocation was expected to jump to about 30% in 2021. Brookfield Asset Management further projects a leap to 60% by 2030.

Demand indeed remains strong for Brookfield Asset Management’s products. For example, in June, it raised US$15 billion for a global transition fund. The company highlighted that it was the largest private fund ever raised to support the transition to net zero carbon.

Value creation continues

Because of certain parts of its businesses, the company’s earnings have been bumpy and unpredictable. However, its cash flow generation has been much smoother. From 2012 to 2021, its operating cash flow per share increased at an incredible compound annual growth rate of almost 20%. Since 2012, the large-cap growth stock has delivered annualized returns of over 15%, despite the meaningful pullback.

Brookfield Asset Management was first a capital investor of proprietary assets before it started investing on behalf of clients. It believes separating these two businesses by the end of the year will further surface value for shareholders.

If you have $1,000 or more you don’t need for the next five years, you should highly consider putting the capital to work in undervalued Brookfield Asset Management before the discount is gone.

The post Where to Invest $1,000 for the Next 5 Years appeared first on The Motley Fool Canada.

Should You Invest $1,000 In Brookfield Asset Management?

Before you consider Brookfield Asset Management, we think you’ll want to hear this.

Our S&P/TSX market beating* Stock Advisor Canada team just released their 5 best stocks to buy this month that they believe could be a springboard for any portfolio.

Want to see if Brookfield Asset Management made our list? Get started with Stock Advisor Canada today to receive all 5 of our Best Buys Now, a fully stocked treasure trove of industry reports, two brand-new stock recommendations every month, and much more.

See Our Best Buys Now * Returns as of 6/21/22

More reading

The Motley Fool recommends Brookfield Asset Management Inc. CL.A LV. Fool contributor Kay Ng owns shares of Brookfield Asset Management.

2022

Yahoo Finance

Yahoo Finance