Where the Average Household Can Afford the Most House

Home prices are on the rise in America’s largest cities, and incomes are just not keeping up. Outside of the wealthiest residents, homeownership is not in the cards for many in those cities. Adding extra pressure on prospective homeowners’ budgets are high debt payments, including record levels of student debt. In fact, debt is an often overlooked factor in the analysis of how much house residents can afford. A family with high household income but a lot of debt can probably not afford as much house as the initial income figures suggest. But being savvy and finding areas with high median incomes and low median house costs allows households to get the most bang for their buck in the housing market. It’s ultimately an undertaking for which you may want to consult a financial advisor to see how homeownership plays into your larger financial plan.

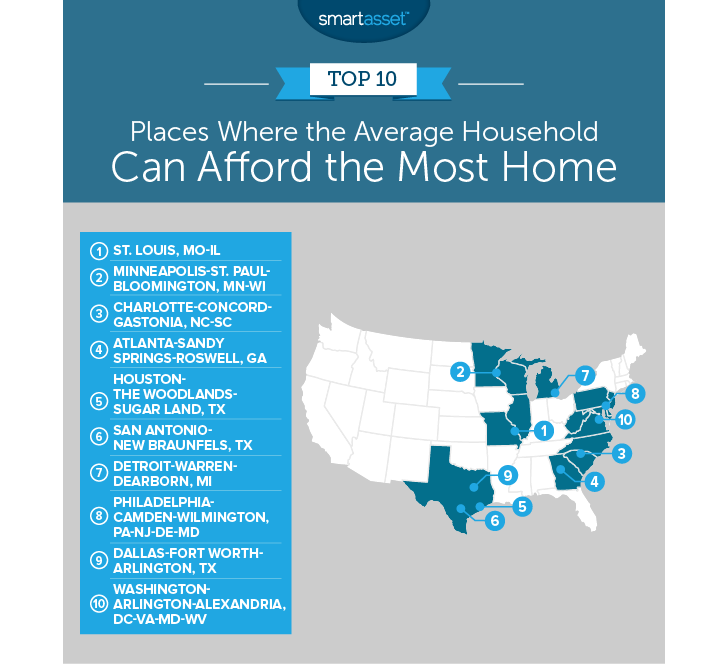

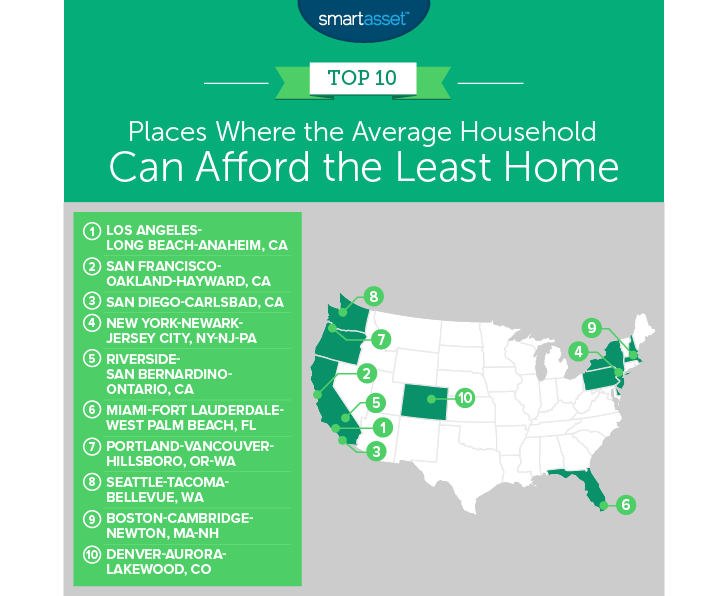

In order to find the places where the average household can afford the least and most house, we looked at data on the 25 largest metro areas. Specifically, we looked at median household income, average non-mortgage debt and local median home values to create our rankings. Check out our data and methodology below to see where we got our data and get a more in-depth description of how we put it together to create our rankings.

Key Findings

California still unaffordable – As residents in the Golden State can attest, homes in California are expensive. And even residents in the highest-paying regions of the state are priced out of the housing market. In metro areas like San Diego, San Francisco and Los Angeles, only the wealthiest locals can afford to buy a home.

It’s not all doom and gloom – In nine out of the 25 metro areas we analyzed, the median household should be able to afford the average home. For the most part, it is affordable metro areas in the Midwest and the South where locals have the best chance at becoming a homeowner. Although even one Northeast metro area – Philadelphia – cracks the top 10.

The Places Where Residents Can Afford the Most Home

1. St. Louis, MO-IL

St. Louis is the metro area with the most affordable homes, according to our analysis. The median household income in this metro area is about $61,600, a bit above the national median. However, while residents here earn an above-average income, home values in the area are actually lower than the national median. The median home here is worth $172,200. But the average household in St. Louis holds nearly $37,000 worth of debt. So after taking that into account, we estimate the average St. Louis household could afford a home worth $233,000, about 35% more than the local median home value.

2. Minneapolis-St. Paul-Bloomington, MN-WI

Households in the Minneapolis area have done a fairly good job at keeping their debt to manageable levels. According to data from Experian, the average household in Minneapolis has about $37,700 in non-mortgage debt. That compares pretty favorably with the local median household income of just under $77,000. Combining these two figures and assuming a down payment equal to five years’ worth of saving 10% of income, we estimate the median household in Minneapolis could afford a home worth $292,000. That’s about 15% more than the latest median home value in Minneapolis, according to Census Bureau data.

3. Charlotte-Concord-Gastonia, NC-SC

The median home in the metro area surrounding the Queen City is worth $197,100, according to the latest Census Bureau estimates. That compares favorably to the situation for the average Charlotte household. The median household here earns just under $61,200, with a total non-mortgage debt of $39,698. Plugging in those two figures, along with a down payment worth 50% of income, shows the median Charlotte metro area household can afford $223,000 worth of house.

4. Atlanta-Sandy Springs-Roswell, GA

Residents in the South have largely avoided the housing crisis facing cities in the Northeast and California. Coming in fourth is the Atlanta-Sandy Springs-Roswell, Georgia metro area. Households here earn about $65,400 on average, the second most in the top five. Despite the high income, Atlanta falls to fourth due to higher debt figures and local housing costs. We estimate the average Atlanta household could afford a home worth $240,000, 12% higher than the local median home value.

5. Houston-The Woodlands-Sugar Land, TX

The median home around Houston is worth just under $193,000. That is equal to three times the local median household income. After taking debt and property taxes into account, we estimate the median household can afford a home worth $206,000. Speaking of property taxes, Houston has larger than average property taxes, which can hurt. But that should not scare away homeowners entirely. After all, Texas also has no state income tax.

The Places Where Residents Can Afford the Least House

1. Los Angeles-Long Beach-Anaheim, CA

If you’re part of a typical household in the Los Angeles metro area, homeownership may be difficult. The median household here earns just under $70,000 per year and has about $39,148 in non-housing debt. That’s not a ton of debt relative to other cities. In fact, both Atlanta and Charlotte have lower income figures with higher debt. But while the income and debt figures in Los Angeles don’t stand out, the home value figures do. The median home is worth more than $617,000. We estimate the average Los Angeles household could afford a home worth $278,000.

2. San Francisco-Oakland-Hayward, CA

San Francisco is the poster child for housing costs run amok. The median home in the area surrounding San Francisco costs just under $850,000, according to Census Bureau data. Even high-earning San Francisco metro area residents are priced out of homeownership. We estimate the average San Francisco metro area resident could afford a home worth $433,000, by far the most in the study.

3. San Diego-Carlsbad, CA

San Diego-Carlsbad ranks 23rd for home affordability. The median household here earns $76,200 and holds about $41,000 in non-housing debt. We estimate, then, that the average household in the San Diego metro could afford a home worth $306,000. Unfortunately for San Diego residents, $306,000 is only 54% of the local median home value. That means residents here will have to keep saving if they want to afford a bigger home.

4. New York-Newark-Jersey City, NY-NJ-PA

Living in the Big Apple means dealing with high home values. And getting outside of New York won’t help too much either. The median home value in the New York metro area is $440,900. We estimate that with an average income of $75,368 and average non-housing debt of $43,210 the average household in the New York metro area can afford $260,000 worth of house. That’s about 59% of the actual median home value in the area.

5. Riverside-San Bernardino-Ontario, CA

Riverside is the fifth-least affordable housing market in our list. We estimate the average household here can afford a home worth $230,000, almost exactly the same as the average household in top-ranked St. Louis. But while the median home in St. Louis is worth $172,200, the median home in Riverside-San Bernardino-Ontario, California is worth about twice as much: $342,300.

Data and Methodology

In order to rank the metro areas where the average household could afford the most and least home we looked at data on four metrics:

Median household income. Data comes from the Census Bureau’s 2017 1-year American Community Survey.

Average non-mortgage debt. Data comes from Experian and is for 2016. To estimate monthly debt payments, we assumed debt would be paid off within 10 years at 6% interest.

Median home value. Data comes from the Census Bureau’s 2017 1-year American Community Survey.

Down payment. We assumed the average household would save 10% of its income for five years.

To create our rankings, we first estimated how much home the average resident could afford. To do this, we ran the above figures through SmartAsset’s how much home can I afford calculator. We then compared how much home the average household could afford to the local median home value. The metro area where the average household could afford the most house relative to the local median home value ranked first. The metro area where the average household could afford the least house relative to the local median home value ranked last.

Tips for Investing in a Home You Can Afford

Keep the extras in mind – Your mortgage will take up most of your attention and income when you’re buying a home. But apart from that, you will also need to keep room in your budget for extras like property taxes, homeowner’s insurance and any other upkeep you need to do. Depending on where you live, these extras can be the difference between buying a home you can afford and buying one you can’t.

Talk to an expert – Your home is likely the largest single purchase you will make in your life. Making a mistake in the home market can set you back years and gravely affect your long-term financial prospects. Why not make sure you are doing all the right things by talking to an expert? A financial advisor can tell you just how much home you can afford or if homeownership is even right for you. If you are unsure of where to find a financial advisor, check out SmartAsset’s financial advisor matching tool. It will match you with up to three local financial advisors who fit your investing needs.

Questions about our study? Contact press@smartasset.com

Photo credit: ©iStock.com/SelectStock

The post Where the Average Household Can Afford the Most House appeared first on SmartAsset Blog.

Yahoo Finance

Yahoo Finance