What's in Store for Taiwan Semiconductor's (TSM) Q4 Earnings?

Taiwan Semiconductor Manufacturing Company TSM is scheduled to report fourth-quarter 2021 results on Jan 13.

For fourth-quarter 2021, Taiwan Semiconductor anticipates revenues between $15.4 billion and $15.7 billion.

The Zacks Consensus Estimate for fourth-quarter revenues is pegged at $16.1 billion, suggesting growth of 27% from the year-ago quarter’s reported figure.

Further, the consensus mark for fourth-quarter earnings is pegged at $1.15 per share, indicating an improvement of 18.6% from the prior-year reported figure.

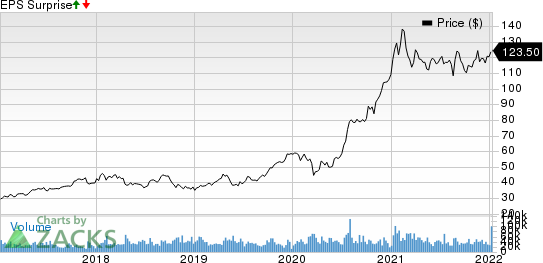

The company surpassed the Zacks Consensus Estimate in all the trailing four quarters, delivering an earnings surprise of 4.6%, on average.

Taiwan Semiconductor Manufacturing Company Ltd. Price and EPS Surprise

Taiwan Semiconductor Manufacturing Company Ltd. price-eps-surprise | Taiwan Semiconductor Manufacturing Company Ltd. Quote

Factors to Note

Taiwan Semiconductor is expected to have benefited from the solid momentum in 5G in the fourth quarter. Strengthening semiconductor demand due to the growing deployment of 5G is expected to have continued benefiting the company.

Acceleration in chip design activity is likely to have aided its performance in the quarter under review.

The company’s strong efforts toward the innovation of technology products are expected to have contributed well to its fourth-quarter performance. Moreover, it is anticipated to have driven revenue growth in high-performance computing (HPC) applications.

The impacts of Taiwan Semiconductor’s deepening focus on the full volume production of 5-nanometer (nm) is expected to get reflected in the to-be-reported quarter’s results. The rising demand for 5nm across smartphone and HPC applications is expected to have been another tailwind.

The launch of the N4X process technology is expected to have aided the company in addressing the demanding workloads of HPC products. This, in turn, is likely to have aided the fourth-quarter performance of the company’s HPC business.

In addition, the growing production of 6nm is expected to have contributed to the to-be-reported quarter’s performance.

Increasing demand for the company’s 7nm technology is expected to have driven its performance in the quarter under review.

Consequently, all these factors are likely to have driven wafer revenue growth of Taiwan Semiconductor in the soon-to-be-reported quarter.

Additionally, the company is likely to have gained from the growing proliferation of gaming, wearables, drones and VR/AR devices. The growing adoption of cloud services fueled by the coronavirus-induced work and learn-from-home necessity, which has boosted the demand for data-center chips, is expected to have been another positive.

The fourth-quarter results are also anticipated to reflect the benefits from the growing foundry industry and the increasing proliferation of IoT products.

However, headwinds related to the pandemic are anticipated to get reflected in the to-be-reported quarter’s results. The global shortage of semiconductor capacity due to supply-chain disruptions is expected to have affected the company’s performance in the fourth quarter.

What Our Model Says

Our proven model doesn’t conclusively predict an earnings beat for Taiwan Semiconductor this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Taiwan Semiconductor has a Zacks Rank #3 and an Earnings ESP of 0.00%.

Stocks to Consider

Here are some companies, which, per our model, have the right combination of elements to post an earnings beat in their soon-to-be-reported quarterly results.

STMicroelectronics STM has an Earnings ESP of +0.76% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

STMicroelectronics is scheduled to release the fourth-quarter fiscal 2021 results on Jan 27. The Zacks Consensus Estimate for STM’s earnings is pegged at 66 cents per share, suggesting an increase of 4.8% from the prior-year reported figure.

Entegris ENTG has an Earnings ESP of +2.02% and a Zacks Rank #2 at present.

Entegris is scheduled to release the fourth-quarter fiscal 2021 results on Feb 1. The Zacks Consensus Estimate for ENTG’s earnings is pegged at 89 cents per share, which suggests an increase of 25.3% from the prior-year reported figure.

Silicon Motion Technology SIMO has an Earnings ESP of +1.13% and a Zacks Rank #3 at present.

Silicon Motion Technology is set to report the fourth-quarter fiscal 2021 results on Jan 26. The Zacks Consensus Estimate for SIMO’s earnings is pegged at $1.77 per share, which suggests an increase of 105.8% from the prior-year reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

STMicroelectronics N.V. (STM) : Free Stock Analysis Report

Entegris, Inc. (ENTG) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

Silicon Motion Technology Corporation (SIMO) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance