What's in Store for Synchrony Financial (SYF) Q4 Earnings?

Synchrony Financial SYF will release fourth-quarter 2021 results on Jan 28, before market open.

SYF reported third-quarter 2021 earnings per share of $1.67, which surpassed the Zacks Consensus Estimate by 12.1%. The bottom line more than doubled year over year.

Synchrony Financial’s results benefited from solid growth in new accounts, higher purchase volume and lower expenses in the last reported quarter.

Earnings Surprise History

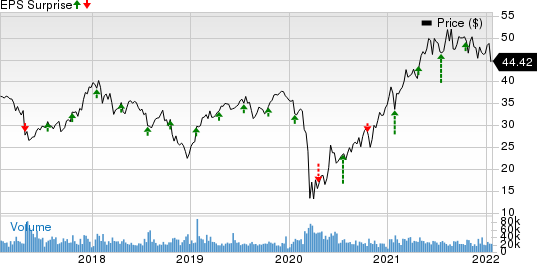

Synchrony Financial boasts an encouraging earnings surprise record. The bottom line beat estimates in all the last four quarters, the average being 26.97%. This is depicted in the chart below:

Synchrony Financial Price and EPS Surprise

Synchrony Financial price-eps-surprise | Synchrony Financial Quote

Let’s see how things have shaped up prior to the fourth-quarter earnings announcement.

Key Factors to Impact Q4 Results

Synchrony Financial is likely to have gained from better net interest income. The consensus mark for SYF’s revenues suggests an upside of 2.4% from the year-ago period’s reported figure.

SYF is expected to have consistently gained from its digital sales volume in the to-be-reported quarter.

The financial service provider is expected to have witnessed a decline in expenses in the to-be-reported quarter owing to reduced operational losses.

Synchrony Financial is expected to have benefited from a better purchase volume as the economy is bouncing back and people are spending more now.

SYF is likely to have gained from new account volume, which increased over the last few quarters. Other factors contributing to this upside include average active accounts. The consensus mark for total purchase volume implies an upside of 12.3% from the year-ago period’s reported figure.

Synchrony Financial is likely to have continued with capital deployment in the fourth quarter, providing a further cushion to its performance.

The Zacks Consensus Estimate for fourth-quarter earnings stands at $1.50, indicting an upside of 21% from the year-ago quarter’s reported number.

The Zacks Consensus Estimate for the efficiency ratio is pegged at 38.08%, suggesting an upside from the prior-year period’s reported figure of 37.10%.

What the Quantitative Model Predicts

Our proven model doesn’t predict an earnings beat for Synchrony Financial this reporting cycle. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of a positive surprise, which is not the case here. You can see the complete list of today’s Zacks #1 Rank stocks here.

Earnings ESP: Synchrony Financial has an Earnings ESP of -4.37%. This is because the Most Accurate Estimate is pegged at $1.43, lower than the Zacks Consensus Estimate of $1.50. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

Zacks Rank: Synchrony Financial currently carries a Zacks Rank #3.

Stocks to Consider

Some stocks worth considering from the finance sector with a perfect mix of elements to surpass estimates in the upcoming quarterly releases are as follows:

Euronet Worldwide, Inc. EEFT has an Earnings ESP of +0.50% and a Zacks Rank of 3, currently.

Moodys Corporation MCO has an Earnings ESP of +2.49% and a Zacks Rank #2 at present.

Virtu Financial, Inc. VIRT has an Earnings ESP of +8.25% and is currently Zacks #3 Ranked.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO) : Free Stock Analysis Report

Euronet Worldwide, Inc. (EEFT) : Free Stock Analysis Report

Synchrony Financial (SYF) : Free Stock Analysis Report

Virtu Financial, Inc. (VIRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance