What's in Store for Dell Technologies' (DELL) Q3 Earnings?

Dell Technologies DELL is set to release third-quarter fiscal 2020 results on Nov 26.

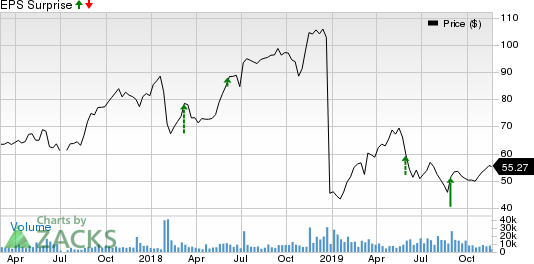

The Zacks Consensus Estimate for third-quarter earnings stayed at $1.55 over the past 30 days, which implies a decline of 14.8% from the year-ago quarter’s reported figure.

Moreover, the consensus mark for revenues is $22.90 billion, implying growth of 1.9% from the figure reported in the year-ago quarter.

In second-quarter fiscal 2020, the company posted non-GAAP earnings of $2.15 per share, which beat the Zacks Consensus Estimate by 47.3%.

Additionally, revenues increased 1.4% year over year to $23.45 billion.

Let’s see how things are shaping up for this announcement.

Factors to Watch

Dell is expected to benefit from its dominant position in the enterprise IT solutions market. Strong spending by customers on infrastructure is an upside.

The company is also likely to gain from the ongoing momentum at VMware VMW, in which it has a majority stake. Further, Dell owns stakes in Pivotal Software (which VMware is set to buy) and SecureWorks.

Notably, VMware reported an impressive second-quarter fiscal 2020. Non-GAAP earnings rose 3.9% year over year on revenues of $2.44 billion, which grew 12.2%.

VMware’s third-quarter revenues are expected to have benefited from continued enterprise deal wins, dominance in the software-defined data center (SDDC) space and the expanding customer base in cloud.

Additionally, the third-quarter top line is expected to reflect Dell’s continuing share gain in the PC market. The company was ranked third by Gartner and recorded seventh consecutive quarter of PC shipment growth in third-quarter 2019. The healthy gaming business coupled with a strong commercial-centric product portfolio was a major driver. The company with a market share of 17.1% witnessed 5.3% growth during the quarter under consideration, going by IDC’s figure.

Moreover, Dell’s expanding portfolio offerings for data centers are expected to have boosted revenues. However, weakness in the server market is expected to have hurt Dell’s top line in the to-be-reported quarter. Notably, the company faces stiff competition in the server market from Hewlett Packard Enterprises HPE.

Per IDC data, Dell’s market share contracted 30 basis points (bps) on a year-over-year basis to 19% in second-quarter 2019. Hewlett Packard Enterprises, on the flip side, expanded 150 bps to 18%.

Key Q3 Developments

During the quarter, Dell and AT&T T announced a collaboration to explore the key open infrastructure technology areas in the next-gen edge computing space with the rapid evolution of 5G.

The company also announced that Dell Technologies Cloud will support automated deployment of VMware PKS on Dell EMC VxRail, adding integrated support for Kubernetes and containers.

Moreover, Dell introduced Cloud Validated Designs for Dell EMC PowerMax and Dell EMC Unity storage arrays. The company also launched Cloud Validated Designs for Dell EMC PowerEdge MX servers.

Additionally, the company announced the availability of the fully-managed Cloud Data Center-as-a-Service offering, VMware Cloud on Dell EMC, for the U.S. customers.

Zacks Rank

Dell currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +24.5% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Click to get this free report Hewlett Packard Enterprise Company (HPE) : Free Stock Analysis Report AT&T Inc. (T) : Free Stock Analysis Report Dell Technologies Inc. (DELL) : Free Stock Analysis Report VMware, Inc. (VMW) : Free Stock Analysis Report To read this article on Zacks.com click here. Zacks Investment Research

Yahoo Finance

Yahoo Finance