What's in the Cards for TE Connectivity's (TEL) Q1 Earnings?

TE Connectivity Ltd. TEL is scheduled to report first-quarter fiscal 2021 results on Jan 27.

For the fiscal first quarter, the company projects net sales of $3.2 billion. The Zacks Consensus Estimate for the same is pegged at $3.26 billion, indicating growth of 2.9% from the prior-year quarter’s reported figure.

Further, the company projects adjusted earnings of $1.25 per share. The consensus mark for the same stands at $1.28 per share, suggesting an increase of 5.8% from the year-ago reported figure.

Notably, the company surpassed the Zacks Consensus Estimate in each of the trailing four-quarter, the average surprise being 27.95%.

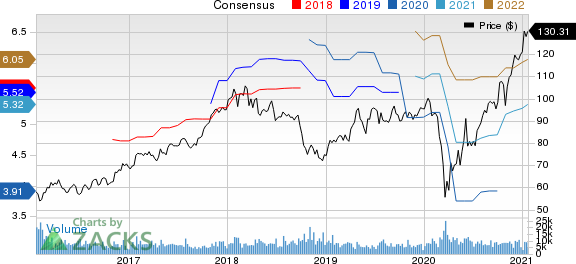

TE Connectivity Ltd. Price and Consensus

TE Connectivity Ltd. price-consensus-chart | TE Connectivity Ltd. Quote

Factors to Note

TE Connectivity’s footprint-consolidation plans and stringent cost-cutting strategies are expected to get reflected in the fiscal first-quarter results.

Further, recovering overall auto production along with the increasing production of hybrid and electric vehicles is anticipated to have contributed well to sales growth of the company’s Transportation segment inthe to-be-reported quarter.

Additionally, solid content growth is expected to have benefited the segment’s fiscal first-quarter performance.

In the Communication segment, strengthening momentum across data and devices as well as appliances is anticipated to have acted as a tailwind in the quarter under review. Also, growing traction across high-speed solutions for cloud applications is likely to have remained the key catalyst.

Further, recovery in Asia and especially in China is anticipated to have continued benefiting the segment in the soon-to-be-reported quarter.

Furthermore, benefits from the First Sensor acquisition are expected to get reflected in TE Connectivity’s sensor business performance in the fiscal first quarter.

In addition to this, strength across themedical business is anticipated to have contributed well to the Industrial segment’s sales in the quarter under review.

All the above-mentioned factors are likely to have benefited TE Connectivity’s topline inthe fiscal first quarter.

However, sluggishness in commercial aerospace and uncertainties related to the coronavirus pandemic are expected to get reflected in the quarterly results.

What Our Model Says

Our proven model conclusively predicts an earnings beat for TE Connectivity this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

TE Connectivity has an Earnings ESP of +1.48% and a Zacks Rank #2.

Stocks to Consider

Here are some other companies, which, per our model, also have the right combination of elements to post an earnings beat in their soon-to-be-reported quarterly results.

Alphabet Inc. GOOGL has an Earnings ESP of +0.75% and a Zacks Rank of 2 at present.You can see the complete list of today’s Zacks #1 Rank stocks here.

Vishay Intertechnology, Inc. VSH has an Earnings ESP of +4.82% and a Zacks Rank of 2, currently.

PayPal Holdings, Inc. PYPL has an Earnings ESP of +3.00% and a Zacks Rank of 2, currently.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2021.

Click here for the 6 trades >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TE Connectivity Ltd. (TEL) : Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

PayPal Holdings, Inc. (PYPL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance