What's in the Cards for GDS Holdings' (GDS) Q4 Earnings?

GDS Holdings Limited’s GDS stock has gained 48.6% over the past year against the 15.7% decline of the industry it belongs to. The company is slated to report fourth-quarter 2019 results on Mar 19, before the bell.

Q4 Expectations

The Zacks Consensus Estimate for revenues in the to-be-reported quarter is pegged at $163.8 million, indicating 35.8% growth from the year-ago quarter’s actual figure. The top line is expected to have benefited from increase in total area committed. Notably, burgeoning cloud adoption in China is driving demand from cloud services providers and new commitments from large Internet and financial service institution customers.

In the third quarter of 2019, revenues of $149.2 million increased 34.3% year over year.

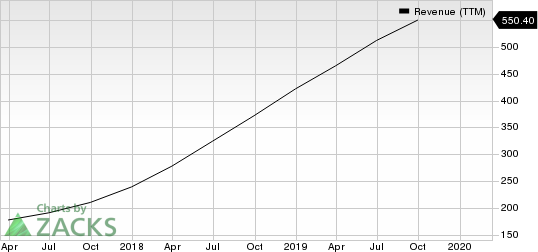

GDS HOLDINGS Revenue (TTM)

GDS HOLDINGS revenue-ttm | GDS HOLDINGS Quote

The Zacks Consensus Estimate for GDS’s bottom line is pegged at a loss of 6 cents for the to-be-reported quarter, indicating improvement from loss of 14 cents incurred in the fourth quarter of 2018. The bottom line is expected to have benefited from operating leverage.

In the third quarter of 2019, the company incurred loss of 12 cents that narrowed 14.3% year over year.

Zacks Rank & Stocks to Consider

GDS currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the broader Zacks Business Services sector are Interpublic IPG, Omnicom OMC and Genpact G, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term expected EPS (three to five years) growth rate for Interpublic, Omnicom and Genpact is 4.5%, 5.6% and 14%, respectively.

Zacks Top 10 Stocks for 2020

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2020?

Last year's 2019 Zacks Top 10 Stocks portfolio returned gains as high as +102.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2020 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicom Group Inc. (OMC) : Free Stock Analysis Report

Interpublic Group of Companies, Inc. (The) (IPG) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

GDS HOLDINGS (GDS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance