What's in the Cards for BlackRock (BLK) in Q2 Earnings?

BlackRock, Inc. BLK is slated to report second-quarter 2019 results on Jul 19, before the opening bell. Its revenues and earnings for the to-be-reported quarter are projected to decline year over year.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate. Results were driven by a decline in expenses and growth in assets under management (AUM).

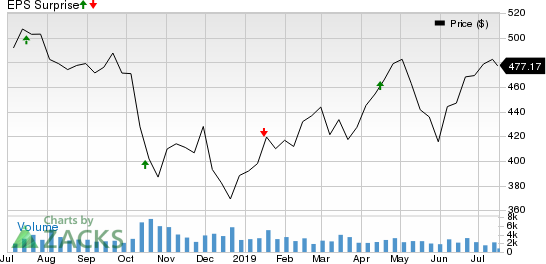

The company boasts a decent earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, the average beat being 3%.

BlackRock, Inc. Price and EPS Surprise

BlackRock, Inc. price-eps-surprise | BlackRock, Inc. Quote

However, BlackRock’s business activities and prospects in the second quarter did not encourage analysts to revise earnings estimates upward. The Zacks Consensus Estimate for earnings of $6.57 has moved down 3.2% over the past 30 days. Moreover, the figure indicates a decline of 1.4% from the year-ago quarter’s reported figure.

The consensus estimate for sales for the second quarter is pegged at $3.56 billion, which suggests a decline of 1.4% from the prior-year quarter’s reported number.

Before we take a look at what our quantitative model predicts, let’s discuss the factors that are likely to impact second-quarter results.

Factors to Influence Q2 Results

BlackRock remains a dominant player in the ETF market, given its continued investments in the U.S. iShare core ETFs. Moreover, as investors are increasing allocations toward ETFs instead of alternative investments to reduce management costs, the company’s iShares inflows are expected to have remained strong in the second quarter. Thus, while unfavorable foreign currency adjustments during the quarter might have had an adverse impact on AUM, total AUM is likely to improve, driven by steady inflows.

The Zacks Consensus Estimate for total AUM for the second quarter is pegged at $6.71 trillion, indicating growth of 6.4% from the year-ago quarter’s reported number.

Despite an expected increase in assets during the second quarter; investment advisory, administration fees and securities lending revenues, which constitute more than 80% of the company’s total revenues, are expected to decline. The Zacks Consensus Estimate for the same is pegged at $2.98 billion, suggesting a decline of 17.4% from the year-ago quarter’s reported figure.

Moreover, performance fee, which is also a major revenue component, is likely to decrease in the quarter to be reported. The Zacks Consensus Estimate for performance fees for the second quarter is pegged at $76 million, which indicates a decline of 16.5% from the prior-year quarter’s reported figure.

BlackRock might witness an increase in costs in the second quarter. The company’s expenses remained elevated over the last few years. In fact, higher compensation as well as marketing costs (related to the company’s brand campaign) along with its plans for improving product offerings may result in an increase in expenses.

Earnings Whispers

According to our quantitative model, it cannot be conclusively predicted whether BlackRock will be able to beat the Zacks Consensus Estimate in the second quarter. This is because it does not have the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — which is required to be confident of an earnings surprise call.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: The Earnings ESP for BlackRock is 0.00%.

Zacks Rank: BlackRock currently carries a Zacks Rank #3. While this increases the predictive power of ESP, we also need a positive ESP to be confident of an earnings surprise call.

Stocks Worth a Look

Here are some finance stocks that you may want to consider as these have the right combination of elements to post an earnings beat this quarter, per our model.

TD Ameritrade Holding Corporation AMTD is slated to release results on Jul 22. It has an Earnings ESP of +0.03% and currently carries a Zacks Rank #3.

T. Rowe Price Group, Inc. TROW has an Earnings ESP of +0.39% and sports a Zacks Rank #1 (Strong Buy) at present. The company is expected to release results on Jul 24.

Ares Capital Corporation ARCC is expected to release results on Jul 30. It presently has an Earnings ESP of +1.02% and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Today's Best Stocks from Zacks

Would you like to see the updated picks from our best market-beating strategies? From 2017 through 2018, while the S&P 500 gained +15.8%, five of our screens returned +38.0%, +61.3%, +61.6%, +68.1%, and +98.3%.

This outperformance has not just been a recent phenomenon. From 2000 – 2018, while the S&P averaged +4.8% per year, our top strategies averaged up to +56.2% per year.

See their latest picks free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

TD Ameritrade Holding Corporation (AMTD) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

Ares Capital Corporation (ARCC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance