What's in the Cards for Aurora Cannabis (ACB) in Q1 Earnings?

Aurora Cannabis Inc. ACB is scheduled to release first-quarter fiscal 2020 results on Nov 14, after the opening bell.

Although the company has a negative average surprise of 33.3% in the trailing four quarters, it delivered a positive surprise of 100% in the last reported quarter.

Q1 Estimates

The Zacks Consensus Estimate for fiscal first-quarter earnings is pegged at a loss of 3 cents. The same for revenues is pegged at $72.8 million, indicating growth of 220.7% from the year-ago reported figure.

Factors to Influence Fiscal Q1

Increase in consumer market cannabis sales is likely to have driven the company’s cannabis net revenues in the fiscal first quarter. Increase in production from Aurora Sky and the company’s Bradford facility might have also contributed to the fiscal first-quarter performance (read more: What’s in Store for Aurora Cannabis’ Q1 Earnings?).

Aurora Cannabis has been successfully executing growth and expansion strategy, which has been driving revenue growth. In fact, in June 2019, the company announced plans for expansion of the consumer cannabis market into vapes, concentrates, and edibles. The company has plans to produce new, high-quality products across Canada in a variety of product categories through a combination of new and improved facilities.

Ongoing improvement in the company’s production cash cost per gram is likely to get reflected in gross margin on cannabis net revenues in the fiscal first quarter.

Further, the company’s medical cannabis sales are likely to reflect consistent growth with regard to patient base.

Solid increase in production, especially at Aurora Sky, is likely to have strengthened Aurora Cannabis’ position in the Canadian consumer market.

In July, the company received Health Canada licenses for outdoor cultivation at two Canadian sites – Quebec and British Columbia. These research sites have been enabling the company to develop new technology, genetics and intellectual property that has been driving sustainable, high-quality outdoor production.

However, intense competition in the medical marijuana space is likely to have affected the fiscal first-quarter performance.

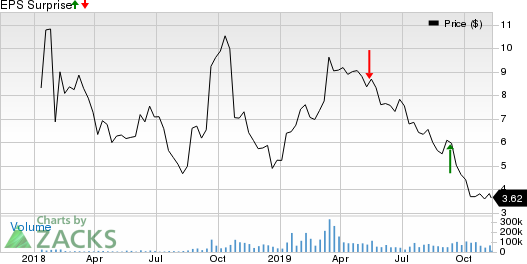

Aurora Cannabis Inc. Price and EPS Surprise

Aurora Cannabis Inc. price-eps-surprise | Aurora Cannabis Inc. Quote

What Our Quantitative Model Suggests

Per our proven model, a combination of — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — increases the chances of an earnings beat. This is not the case here as you will see.

Earnings ESP: Aurora Cannabis has an Earnings ESP of -6.95%. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Zacks Rank: Aurora Cannabis carries a Zacks Rank #3.

Stocks Worth a Look

Here are a few stocks worth considering as they have the right combination of elements to post an earnings beat this time around.

Canopy Growth Corporation CGC has an Earnings ESP of +11.53% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Bank of Montreal BMO has an Earnings ESP of +1.52% and a Zacks Rank #2.

Carnival Corporation CCL has an Earnings ESP of +11.11% and a Zacks Rank #3.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Carnival Corporation (CCL) : Free Stock Analysis Report

Aurora Cannabis Inc. (ACB) : Free Stock Analysis Report

Canopy Growth Corporation (CGC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance