What is an IPO lock-up period? Yahoo U explains

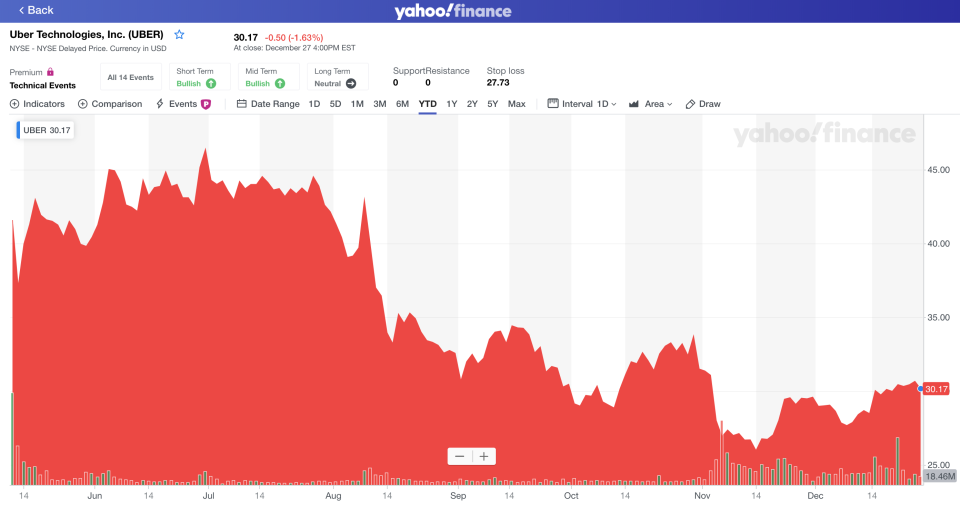

Uber (UBER) co-founder Travis Kalanick dumped his remaining shares of the company this week, finishing a divestment he began when the Uber lock-up expired in November. (Since going public on May 10, Uber’s shares have plunged more than 26%.)

The lock-up refers to a period of time when employees, directors, previous investors, and corporate executives of a newly public company are restricted from selling their stock. When that period ends, a large number of employees can sell off their stock. These lockups can vary in length. Generally, they are between 90 days and 180 days.

Companies can also choose to stagger the lock-ups based on who's holding the shares. For example, in 91 days, investors and employees can sell their shares in the public market. But in six months, chief executives’ shares would be eligible to be sold into the public market. This tiered system was used by Facebook when it went public a few years ago: Its IPO actually had five lock-up dates, ranging from three months to a full year, that gradually allowed the sale of shares.

The reason companies choose to do this is to avoid volatility in the stock price and maintain confidence in the company. Barring those close to the company from selling shares at least through the first few months of a stock being public should prevent erosion of company trust.

The final reason is to protect the reputation of the underwriters. By stabilizing the stock price through lock-ups, the underwriter actually hopes that other companies in the wings looking to go public will consider them. Many IPOs actually give underwriters the discretion to exempt some insiders from a lock-up period, which some critics have blasted as unfair (although legal).

Many newly public companies have struggled this year causing the end of the lock-up period to be an especially big headache for companies.

Valentina Caval is a producer at Yahoo Finance and Brian Cheung is a reporter at Yahoo Finance.

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Yahoo Finance

Yahoo Finance