What Curaleaf's record $950 million deal says about U.S. cannabis consolidation

On Wednesday, Curaleaf CEO Joe Lusardi championed the largest-ever deal between two U.S. cannabis companies as one that united two market-leading brands on the East and West coasts to create a nation leading cannabis powerhouse.

But the nearly $950 million deal, which brings Cura Partners’ Select brand products under the Curaleaf umbrella, is unique in more than just scale.

Unlike the other most recent banner cannabis acquisition, in which Canada’s Canopy Growth agreed to acquire New York-based Acreage Holdings to gain access to the company’s 20 U.S. state licenses and much larger U.S. market, Curaleaf’s deal stemmed from a desire to specifically acquire the most popular cannabis oil brand in California, Nevada and Oregon.

Moreover, the deal combines a brand that was focused on wellness in Curaleaf with a more lifestyle focused brand in Select, which manufacture cannabis oil for vaping, lotions, and gummies. When asked in an interview with Yahoo Finance’s YFi PM if the cannabis consolidation trend with a focus on branding would likely to continue, Lusardi answered, “Without a doubt.”

“If you look at Curaleaf, we’re a mono-branded strategy,” he said. “Our whole business was about building a Curaleaf brand because that’s where we think long-term value will be and so now we’ve brought together the two biggest brands in cannabis and we’re really excited about being able to deliver it to all segments of the cannabis user.”

Aside from combining two popular brands, Lusardi hopes the synergy will lead to cost efficiencies, including a 25% reduction in processing costs and a 50% drop in Select’s material costs. The combined entity will also boast 15 state licenses, which would be just one shy of the number held by Harvest Health & Recreation following its March merger with Verano Holdings. Acreage Holdings would still hold the largest number of state licenses at 20.

Acreage CEO Kevin Murphy predicted other multistate operators might continue to look to consolidate to try and catch up. “Not all the companies in cannabis today need to exist and they won’t exist,” he said.

With the appeal for another international company looking to follow Canopy’s lead in gaining access to the U.S. market, a domestic company boosting its number of state licenses could make for an easy way to stand out. Despite that fact, Lusardi said that wasn’t the core reasoning in his own deal.

“We think the U.S. is the best cannabis market in the world, and it will be the fastest growing and so we’re executing on a strategy to be the biggest company in our own domestic market,” he said. “We’re not really focused on people buying us or any other strategy but executing on what we’re trying to do, which is be the most successful cannabis company in the United States.”

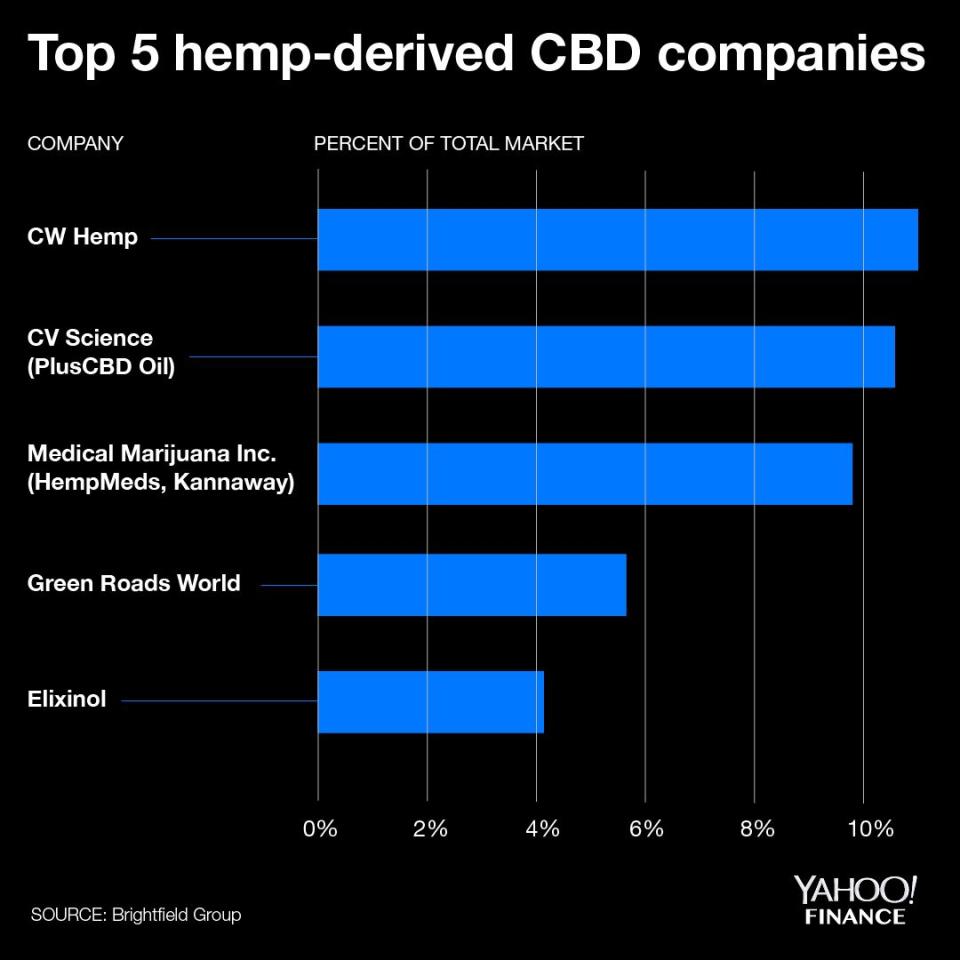

Selling CBD products

Interestingly, as industry expert and Brightfield Group Managing Director Bethany Gomez notes, both companies also had recently inked deals with major retailer CVS. If more national retailers are to follow suit in selling CBD products in multiple states, as have Walgreens and RiteAid, she predicts companies with strong consumer-facing brands will become even more desirable.

“This is an interesting deal because it is not just one multistate operator acquiring another multistate operator to grow retail foothold in new states,” she said. Multistate operators have “predominantly focused on getting in as many states as possible, and oftentimes branding is almost an afterthought. This indicates a shift in that, and I would expect more deals like this over the next 12 months.”

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Blue Moon's creator launched a cannabis beer that sold out in 4 hours

Constellation Brands shareholders are getting Canopy Growth almost for 'free': Canopy CEO

Exclusive: Canopy Growth to invest up to $500 million in hemp production in U.S. states

Yahoo Finance

Yahoo Finance