Westlake Chemical Q2 & FY19 View Falls Short of Expectations

Westlake Chemical Company WLK has issued downbeat earnings guidance for the second quarter and full-year 2019.

The chemical maker expects earnings between 73 cents and 87 cents per share for the second quarter. For 2019, the company sees earnings in the band of $3.10-$4.28 per share, factoring in current margin and pricing expectations for its products in the second quarter and the full year.

The company’s guidance fell short of expectations. The Zacks Consensus Estimate is currently $1.39 per share for earnings in the second quarter. For 2019, the Zacks Consensus Estimate is pegged at $4.96.

For the second quarter, Westlake Chemical envisions net income in the range of $106-$123 million. The company expects EBITDA to improve roughly 8-15% on a sequential comparison basis to between $340 million and $363 million in the second quarter. Net sales for the quarter have been projected in the band of $2.1-$2.2 billion.

For 2019, the company sees net income in the range of $443-$596 million and net sales of between $8 billion and $8.8 billion. EBITDA for the year has been forecast in the range of $1.4-$1.6 billion.

Westlake Chemical noted that while its average margin rose on a sequential comparison basis in the second quarter, it did not increase as much as industry pricing expectations at the start of second quarter.

Westlake Chemical also said that the guidance it has provided is preliminary and subject to change. The company expects to come up with its final second-quarter results on Aug 6.

Shares of Westlake Chemical have lost 34.8% in a year’s time compared with the industry’s 35.6% decline.

Westlake Chemical experienced a difficult pricing environment in the first quarter of 2019, stemming from sharp decline in global crude oil prices in late 2018 along with softer Chinese demand.

The company, during its first-quarter call, said that is cautiously optimistic that trade tensions between the United States and China as well as crude oil prices will improve in second-half 2019.

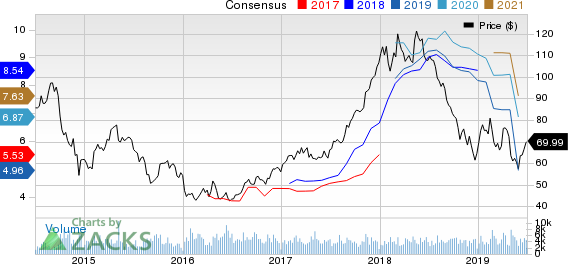

Westlake Chemical Corporation Price and Consensus

Westlake Chemical Corporation price-consensus-chart | Westlake Chemical Corporation Quote

Zacks Rank & Key Picks

Westlake Chemical currently carries a Zacks Rank #5 (Strong Sell).

A few better-ranked stocks in the basic materials space include Materion Corporation MTRN, Flexible Solutions International Inc FSI and Israel Chemicals Ltd. ICL.

Materion has an expected earnings growth rate of 30.3% for the current year and carries a Zacks Rank #1 (Strong Buy). The company’s shares have gained around 22% over the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Flexible Solutions has an expected earnings growth rate of 342.9% for the current fiscal year and carries a Zacks Rank #1. Its shares have surged around 159% in the past year.

Israel Chemicals has an expected earnings growth rate of 13.5% for the current year and carries a Zacks Rank #1. Its shares are up roughly 17% in the past year.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Westlake Chemical Corporation (WLK) : Free Stock Analysis Report

Flexible Solutions International Inc. (FSI) : Free Stock Analysis Report

Israel Chemicals Shs (ICL) : Free Stock Analysis Report

Materion Corporation (MTRN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance