WESCO (WCC) Q1 Earnings & Sales Beat Estimates, Rise Y/Y

WESCO International, Inc. WCC reported first-quarter 2021 adjusted earnings of $1.43 per share, which reflects growth of 57.1% on a year-over-year basis. Also, the bottom line surpassed the Zacks Consensus Estimate by 88.2%.

The company reported quarterly net sales of $4.04 billion, up 105.3% year over year. Also, the figure beat the Zacks Consensus Estimate of $4.03 billion.

Top-line growth was primarily driven by the positive contributions from the company’s merger with Anixter, which was completed on Jun 22, 2020.

Top-line Details

In third-quarter 2020, the company organized the business into three business units namely, Electrical & Electronic Solutions (EES), Communications & Security Solutions (CSS) and Utility & Broadband Solutions (UBS).

EES (42.6% of net sales): Sales in the segment were $1.7 billion for the first quarter, up 54.4% from the year-ago period.

CSS (30.9% of net sales): Sales in the segment were $1.3 billion for the reported quarter, which significantly jumped from $223.7 million in the year-ago period.

UBS (26.5% of net sales): Sales in the segment were $1.1 billion for the reported quarter, up 69.7% from the year-ago period.

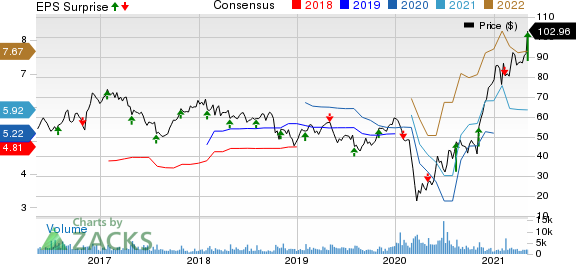

WESCO International, Inc. Price, Consensus and EPS Surprise

WESCO International, Inc. price-consensus-eps-surprise-chart | WESCO International, Inc. Quote

Operating Details

Gross margin was 20.1% for the reported quarter, which expanded 100 basis points (bps) from the year-ago period.

Further, selling, general and administrative expenses were $636.6 million, up 112.6% from the year-ago quarter.

WESCO’s adjusted operating margin was 4.2%, which expanded 90 bps from the prior-year quarter.

Balance Sheet & Cash Flow

As of Mar 31, 2021, cash & cash equivalents were $303.9 million, up from $449.1million as of Dec 31, 2020.

Long-term debt was $4.6 billion at the end of the first quarter versus $4.4 billion at the end of the fourth quarter of 2020.

WESCO generated $120.5 million cash from operations in the reported quarter compared with $125 million of cash from operations in the previous quarter.

Further, the company generated $124.8 million of free cash flow in the first quarter.

Guidance

For 2021, management has raised its guidance for sales growth from 3-6% to 4.5-7.5%. The Zacks Consensus Estimate for 2021 sales is pegged at $16.9 billion.

In addition, adjusted EBITDA margins are expected to expand 5.8-6.1%.

Further, the company raised the guidance for adjusted EPS from $5.50-$6.00 to $6.80-$7.30. The Zacks Consensus Estimate for earnings is pegged at $5.92 per share.

Zacks Rank & Stocks to Consider

WESCO currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector worth consideration are Agilent Technologies A, Pure Storage PSTG and NVIDIA NVDA. All the stocks carry a Zacks Rank #2 (Buy), at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth rate of Pure Storage, NVIDIA and Agilent, is pegged at 52.21%, 15.05% and 9%, respectively.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

WESCO International, Inc. (WCC) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Pure Storage, Inc. (PSTG) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance