Weekly Forex Technical Analysis, Oct 2 – Oct 6, 2017

The US Dollar rose to its five-week high during the previous week on Hawkish Fed after Yellen’s speech and better than expected economic data. The Euro was under pressure as the German elections and comments by the ECB weighed on the currency. The EUR/USD finished the week at 1.1814, down 0.0133 or -1.11%.

In the week ahead, investors will closely watch:

RBA Rate Decision on Tuesday at 4:30 GMT

US ADP Employment on Wednesday at 11:25 GMT

US Trade Balance on Thursday at 13:30 GMT

US Non-Farm Payrolls on Friday at 13:30 GMT

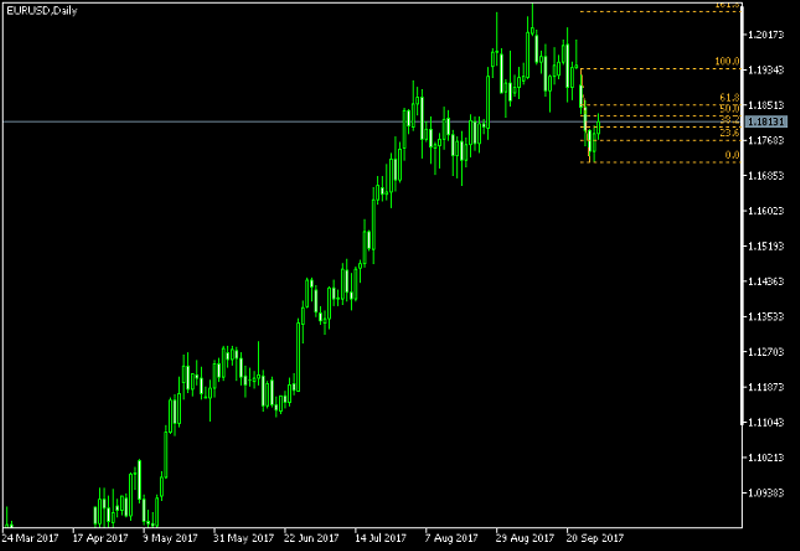

EUR/USD

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

1.1488 | 1.1603 | 1.1708 | 1.1822 | 1.1927 | 1.2042 | 1.2147 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

1.1717 | 1.1769 | 1.1801 | 1.1827 | 1.1853 | 1.1937 |

GBP/USD

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

1.3075 | 1.3209 | 1.3303 | 1.3437 | 1.3531 | 1.3665 | 1.3759 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

1.3343 | 1.3396 | 1.3430 | 1.3457 | 1.3483 | 1.3571 |

USD/JPY

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

109.74 | 110.61 | 111.53 | 112.39 | 113.31 | 114.18 | 115.09 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

111.47 | 111.89 | 112.15 | 112.36 | 112.57 | 113.26 |

EUR/JPY

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

129.15 | 130.45 | 131.64 | 132.94 | 134.13 | 135.43 | 136.62 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

131.75 | 132.33 | 132.70 | 132.99 | 133.29 | 134.24 |

GBP/JPY

Floor Pivot Points

3rd Sup | 2nd Sup | 1st Sup | Pivot | 1st Res | 2nd Res | 3rd Res |

146.93 | 148.34 | 149.46 | 150.86 | 151.98 | 153.38 | 154.50 |

Fibonacci Retracement Levels

0.0% | 23.6% | 38.2% | 50.0% | 61.8% | 100.0% |

149.75 | 150.34 | 150.71 | 151.01 | 151.30 | 152.27 |

This post was originally published by EarnForex

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance